Bonzo Finance Incident Report for August 6th

Date of event: August 6, 2025 (ET)

Markets: Primarily $BONZO used as collateral; borrowed $USDC

Protocol status: Fully operational; user deposits and positions are safe.

Summary

On August 6th, it was observed that a position in Bonzo Finance utilizing $BONZO governance tokens as a primary form of collateral — used to borrow Hedera native $USDC — fell below a health factor (HF) of 1, due to observed standard market volatility. This caused a sharp decline of cascading liquidations, and a subsequent recovery.

No malicious behavior was observed. The protocol’s functionality and, in conjunction, its ecosystem (i.e., liquidation bots, oracles, etc.) appear to have operated exactly as intended. No exploits were observed or triggering of downtime (freezing/pausing) across markets.

Background

Position Information

The position cited below — with estimated token amounts, prior to the event — is primarily done so only due to its magnitude, relative to other positions within the protocol; in addition, it was observation to be the first position that experienced liquidation related to this event.

Many positions which utilized $BONZO as collateral were involved and contributing factors in an event that should be viewed as broad and complex, with many levels of interdependency. This includes but is not limited to the market volatility of debt positions with volatile assets, using $BONZO governance tokens as collateral.

- Collateral #1: $BONZO / Est. 5M - 6M Tokens

- Collateral #2: $SAUCE / Est. 2.5M - 3M Tokens

- Collateral #3: $XSAUCE / Est. 500k - 800k Tokens

- Debt #1: $USDC / Est. 580k - 640k Tokens

Position Behavior

Ongoing maintenance of this position appeared automated, periodically repaying debt or supplying collateral to keep HF within a range of 1.1 - 1.3. There is no evidence of malicious intent. The account was highly leveraged in a single asset used as collateral ($BONZO governance tokens), along with two other assets ($SAUCE & $XSAUCE governance tokens) used as collateral in relatively smaller amounts.

Additional Notes

This position is not one held by contributors of the Bonzo Finance protocol or any affiliated organization, nor was any of the market activity cited below.

Timeline (ET) August 6th, 2025

- ~5:40pm ET: Standard market activity of $BONZO governance token, resulting in market fluctuation

- ~5:49pm ET: Automation by position holder to maintain >1 health factor via withdraw of 70,000 $SAUCE governance tokens tied to 2 steps listed below.

- ~5:53pm ET: Continued automation by position holder to maintain >1 health factor via sale of 70,000 $SAUCE for 3,743 $USDC tied to 1 step listed below.

- ~5:53pm ET: Automation by position holder to maintain >1 health factor via repayment of 3,743 $USDC debt.

- ~5:53pm ET: Position holder Health Factor does not recover and drops < 1.

- ~5:54pm ET: Liquidation Bot’s first repayment of ~18k $USDC debt + seizing of ~204k $BONZO governance token collateral (transaction / trace) from position holder, increasing the position health factor > 1.

- ~6:18pm ET: First sale of ~119k of seized $BONZO (transaction) on SaucerSwap contributed to market instability, pushing the position health factor < 1.

- >6:18pm ET: Amplification of continued market volatility due to cascading liquidations, driven by seized $BONZO governance token sales from the first liquidation.

- ~6:42pm ET+: Attempted failed automations / transactions by position holder to maintain health factor >1.

Liquidations Explained

- When the Health Factor (HF) < 1, a position becomes eligible for liquidation.

- A liquidator can repay up to 50% of the borrower’s debt (the close factor) and seize collateral with a liquidation bonus (varies by asset).

- Liquidators choose their strategy — either to slowly chip away at unhealthy positions or to repay near the close factor to seize more collateral faster. Protocols don’t control which plan they choose, when they act, or whether they later sell the seized collateral.

- Read more about the mechanism of liquidations in the official documentation.

Immediate / Precautionary Actions

The Bonzo Finance Labs team, under the direction of its risk services provider, implemented precautionary protective risk parameter adjustments while a deeper review is completed.

Lowered LTVs (reducing borrow power) and supply caps, while keeping Liquidation Thresholds unchanged, for long-tail assets, avoids introducing liquidation risk for existing borrowers, while limiting the potential for new, overly risky positions to accumulate.

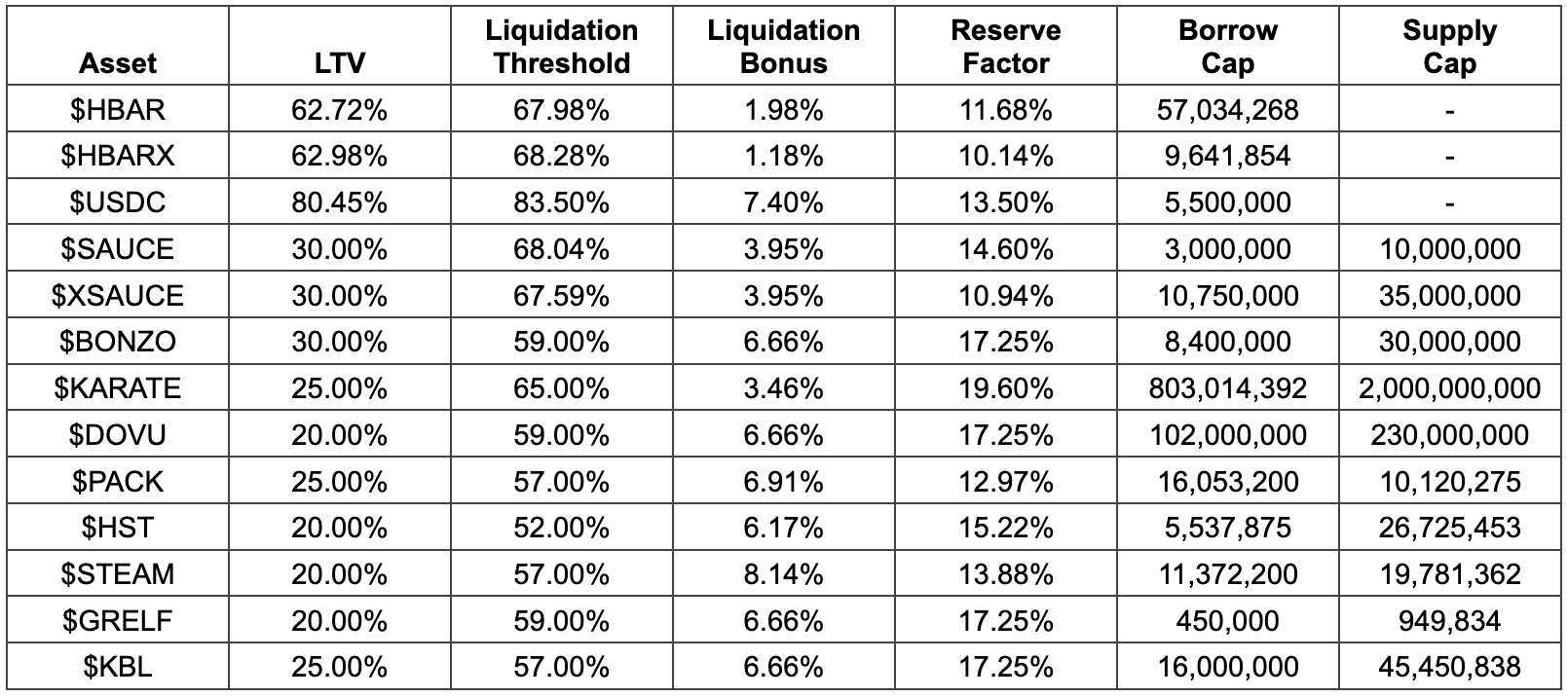

Current parameters are visible below; the history of parameter changes and up-to-date parameters can be found in the Risk Framework documentation of the Bonzo Finance protocol.

A Path Towards Safe Scalability for Bonzo Finance

While the event was notably disruptive, it is an acknowledgement that the protocol has achieved a level of liquidity and growth that warrants adjustments; these adjustments are in support of safely scaling the protocol, its users, and the broader Hedera DeFi ecosystem to its next attainable levels.

Adjusting Precautionary Risk Parameters

One of the more pertinent questions from community members is about risk parameters and temporary reduction measures. As the community has seen over time, the Bonzo Finance Labs team takes the security, risk, and protection of users, the protocol, and the broader ecosystem seriously.

This is balanced with ensuring the protocol offers the desired utility to users and provides the flexibility for them to make their own assessment / decision on utilization. The temporary parameter lowering for “long-tail ecosystem assets” is precautionary; they will be adjusted, but with no guarantees that all will be raised.

Independent Risk Stewards / Ecosystem Contributors

The protocol has matured quickly and has reached a level, relative to its ecosystem, that warrants adjustments, allowing it to continue scaling safely. The protocol aims to mature its parameter update operations with greater expertise, decentralization, and process, while laying a foundation for planned DAO Governance in Q4 2025/Q1 2026.

This includes onboarding a contributor to the Bonzo Finance ecosystem, acting in the capacity of an independent risk steward / expert; they take on a proactive role of not only comprehensive risk analysis (as is had today by private, contracted parties), but also processes for transparent authorship and justification of parameter updates visible to community pre-DAO and voted upon by community post-DAO.

Proposals of this nature include adjustments per-asset to: Loan-to-Value (LTV), LT (Liquidation Threshold), LB (Liquidation Bonus), Reserve Factor, Supply / Borrow Caps, and Interest Rates (Slope 1, Slope 2, Optimal Utilization).

It’s envisioned that this mirrors the DAO Governance processes seen across mature and established web3 lending protocols, like Aave and Compound. For a more comprehensive understanding of these processes, it’s recommended to observe the DAO governance proposals and discussions seen on Aave and Compound.

Focusing on High-Impact Asset Utility: Stablecoins

While the changes above primarily address market risk, they also support scaling the protocol’s utility / liquidity, and drive economic sustainability via protocol revenue.

The most critical asset for lending protocols is stablecoins, which, in Hedera / Bonzo Finance’s case, is native $USDC. The risk adjustment process outlined above aims to improve the Hedera native $USDC market in Bonzo Finance by implementing borrow cap / interest rate adjustments that support more consistent and comparable interest rates, enabling greater utilization and supply. The $USDC market is directly impacted by long-tail ecosystem asset markets, and cannot be adjusted in silo, as all markets supported by the protocol are interdependent.

Conclusion

The above information provides insight into the event which took place on August 6th, 2025 and the near-term changes that focus on supporting the protocol’s ability to safely scale to its next level. This recent event and subsequent actions can be viewed as a growing pain for the protocol, but also a signal of its finding of success.

Bonzo Finance Labs is committed to keeping its community informed throughout these changes; as more information becomes available, details will follow via the Bonzo Finance blog, Discord, and X.

The team is always open to answering questions from the community; we recommend joining us on Discord for the most up-to-date information and responsiveness.

Notable Questions

Did the protocol operate as expected or were operations a contributing factor?

Throughout the event, the Bonzo Finance protocol and its ecosystem (including liquidation bots and oracles) were observed to have functioned as they should; swift and efficient liquidations of positions, tied to market movements, ensures that the protocol can remain operational.

Was this an exploit?

No. This was a market-driven liquidation sequence in line with protocol operations. Health factors dropping below 1 for debt positions trigger liquidation eligibility; liquidators repay debt and seize collateral with a bonus. Docs.bonzo.finance

Did the protocol incur any bad debt?

When an asset supported by a decentralized lending protocol experiences a swift and continuous downturn, this opens up the potential for accumulation of bad debt. The protocol finalized this event with $112.15k of debt in $USDC; the protocol can continue its operations safely and no immediate action is required. This debt will be covered by the protocol treasury over time, with no impact on users / positions, as is done by lending protocols across the industry (1, 2, 3).

Who operates liquidation bots?

Independent ecosystem contributors, Bonzo Finance and its affiliated organizations, do not operate liquidation bots. The Bonzo Finance documentation provides ecosystem developers with information on building and deploying independently operated liquidation bots. docs.bonzo.finance

Where can I learn more about liquidations?

See the liquidations section of the Bonzo Finance documentation. docs.bonzo.finance

Which Oracle provider(s) are utilized by the Bonzo Finance protocol

Bonzo uses Chainlink and Supra for price feeds. Docs.bonzo.finance

Share this post on