Bonzo Finance: Mainnet Launch Recap & Vision for the Future

Bonzo Finance’s mission since inception has been to become The Liquidity Layer of Hedera — helping usher in DeFi 2.0 on the network and drive key DeFi health metrics, such as overall Hedera network TVL, stablecoin liquidity and utilization, and DEX trading volume and liquidity. While at the same time, opening the door to brand new types of DeFi transactions, strategies, and incentive models for retail and institutional users not previously possible.

October 28th marked the beginning of that journey into DeFi 2.0 on Hedera with the launch of Bonzo Finance — a decentralized lending & borrowing protocol based on Aave. In addition to its launch on Hedera, Bonzo Finance has formed inroads with Supra’s EVM L1 network and ecosystem as a next frontier to grow the protocol’s adoption and liquidity, while working towards achieving an overarching goal of economic sustainability.

Let’s take a look at what was launched and how Bonzo Finance performed during its first week, which features and functionalities are coming soon, and how the Bonzo Finance Labs team is thinking about the future of the protocol’s evolution.

Hedera Mainnet Launch Recap

Bonzo Finance launched on the Hedera mainnet Monday, October 28th, 2024. Bonzo Finance launched with support for HashPack wallet, using the HashConnect standard, and just recently migrated to the updated WalletConnect standard, with support for both HashPack and Kabila wallets.

Within 2 hours, the protocol amassed over $1M in liquidity across a diverse range of supported crypto assets found in the Hedera ecosystem: $HBAR, $HBARX, $USDC, $SAUCE, $XSAUCE, $DOVU, $PACK, $KARATE, $STEAM, $HST.

To ensure the highest degree of safety for users and the ecosystem, only the supplying of assets has been enabled for launch. This was a conscious decision to ensure sufficient liquidity in the protocol, prior to enabling borrowing, to protect against extremely volatile borrow interest APYs which could result in unforeseen liquidations.

To support liquidity initiatives, Bonzo Finance has forged partnerships with the DOVU, Karate Combat, & Earthlings teams — these projects graciously offered liquidity incentives, in order to further incentivize token holder participation. The DOVU team provided 10M $DOVU, Karate Combat provided 20M $KARATE, and Earthlings provided 1.8M $STEAM. Bonzo Finance is incredibly grateful for their partnership and looks to continue working with leading projects across the ecosystem to further make “DeFi 2.0 on Hedera” a reality.

Uniquely, lending protocols are capable of unlocking dormant liquidity across the DeFi ecosystems on which they’re deployed; lending pools are single-asset pools that do not experience impermanent loss, like on decentralized exchanges, making them an ideal place to park dormant liquidity and often used for treasury management activities by token-based projects.

Within two weeks, ~$5M in liquidity had been supplied to Bonzo Finance across its full range of supported assets, satisfying its minimum liquidity thresholds required to enable borrowing. The speed at which Bonzo met these thresholds was faster than anticipated, and the Bonzo Finance Labs team is working to safely enable borrowing, with our partner Ledger Works, a real-time risk mitigation provider for DeFi protocols, within the next 2-3 weeks.

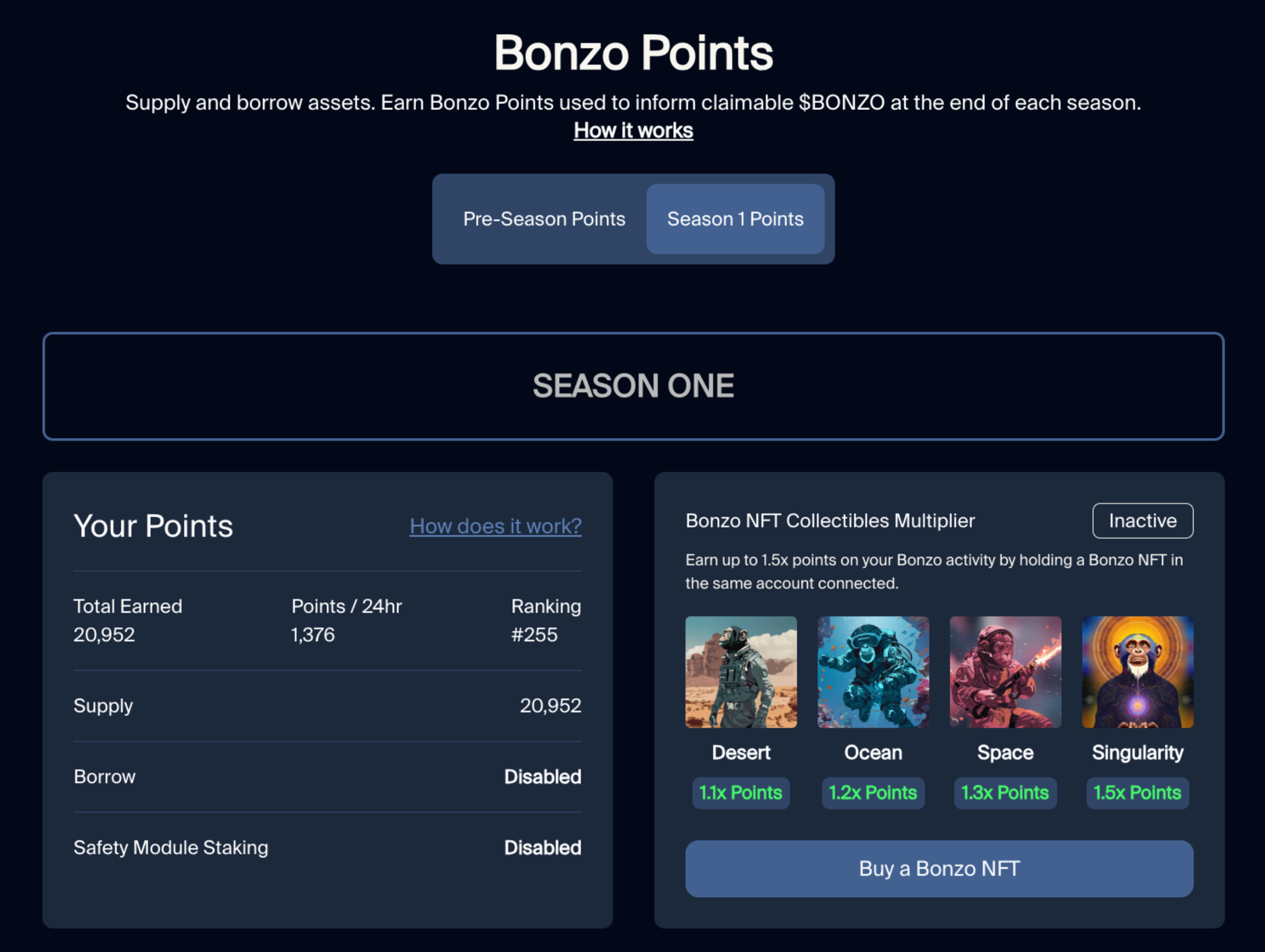

Season One of Bonzo Points

In conjunction with the mainnet launch of Bonzo Finance, the protocol also kicked off Season One of Bonzo Points. Points programs are used widely across web3 to incentivize and promote user adoption, engagement, and growth, rewarding users for activities that contribute to the overall health of the protocol. It also creates a competitive environment, with a leaderboard, as well as points multipliers for holding Bonzo Finance NFTs.

Bonzo Points run for three full seasons, each lasting 3-4 months each; to start out, 4 points are earned for every $USD in value of tokens supplied, every 24 hours. Once borrowing is enabled, users will earn 2 points or $USD supplied, and 8 points per $USD borrowed.

At the end of every points season, Bonzo Points earned across all accounts is used to inform $BONZO tokens that become claimable by participants.

Protocol Performance

As of November 13th, 2024, $5.06M in liquidity has been supplied to Bonzo Finance and this metric continues to grow daily. Once borrowing is enabled, allowing users to use collateralized assets to borrow against their value, it’s anticipated that more liquidity will be added for this activity.

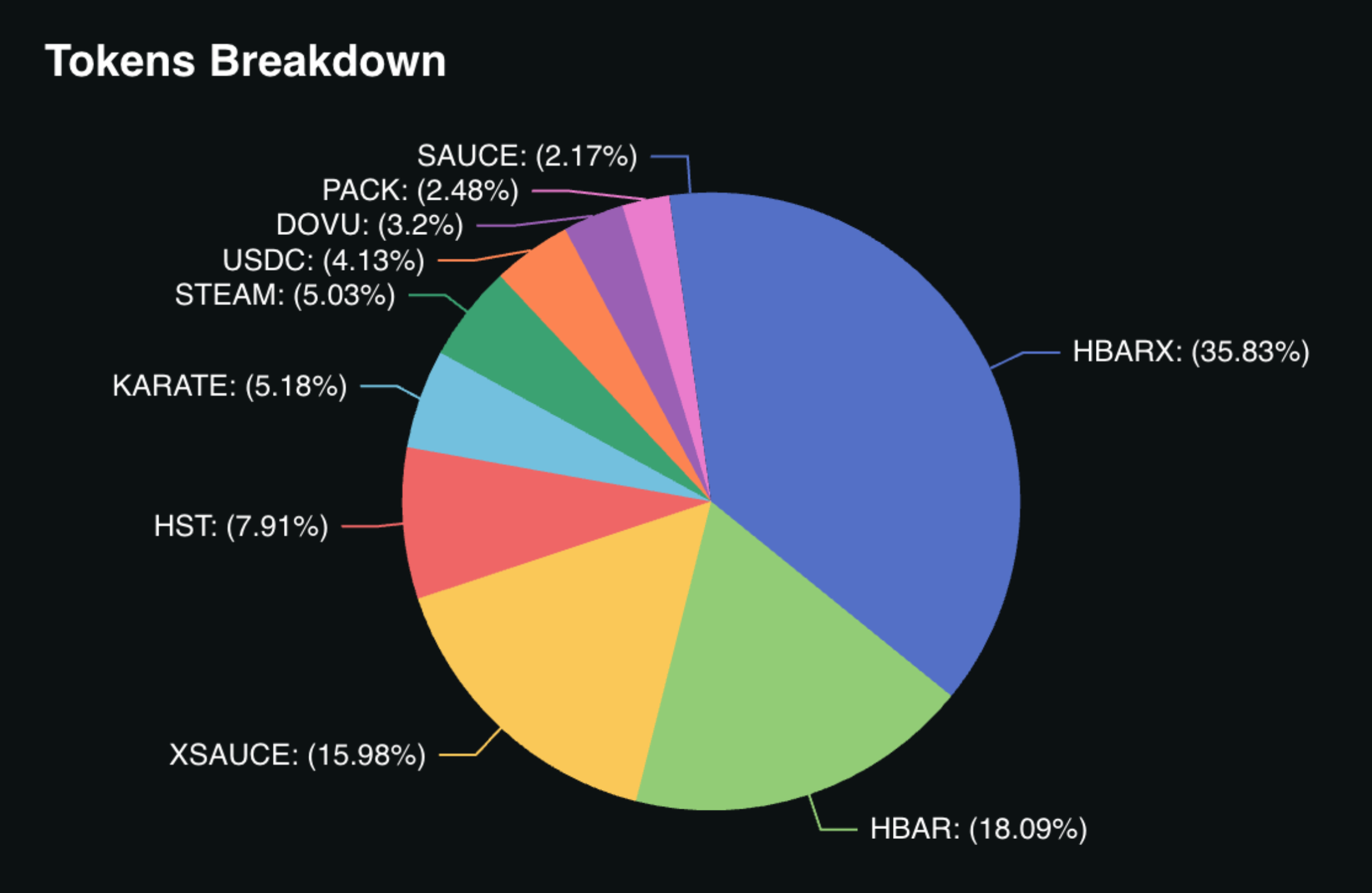

An important aspect of DeFi protocol liquidity is diversification — having a majority of protocol liquidity being supplied into a single asset, or having a single account supplying a majority of liquidity, creates undue risk.Today, Bonzo Finance has a healthy diversification of liquidity across all supported assets, as depicted in the pie chart below from DeFi Llama. In addition, over 400 users across the Hedera DeFi ecosystem are participating in supplying liquidity to the protocol. More fine-grained global metrics, as well as individual asset metrics, will be coming soon.

Vision for the Future

Bonzo Finance’s mission is to become the liquidity layer of the networks on which the protocol is deployed — unlocking dormant liquidity across their ecosystems and enabling advanced DeFi functionality for retail and institutional users. We’re looking forward to the future of DeFi on Hedera and other major networks on which the protocol launches.

Upcoming Features & Functionalities

The Bonzo Finance roadmap includes a number of upcoming features and functionalities to be developed between now and Q2 2025; they include, but are not limited to, the following:

- Enabling borrowing in partnership with real-time risk mitigation provider Ledger Works

- Enabling the flash loans & liquidation bots ecosystem, which keeps the protocol healthy and creditors whole.

- A global analytics dashboard (the “scoreboard”), as well as per-asset analytics

- Account transaction history with greater insight into liquidations

- The $BONZO token generation event (within 3 months post-mainnet launch)

- The Bonzo Finance Safety Module & $BONZO staking mechanism

- MetaMask & MetaMask Snaps wallet support

- Collateral swaps

- Bridge integration (Axelar) and support for wrapped major assets

- The Bonzo Finance DAO launch & tooling to support proposals and token-weighted voting

- Advanced DeFi capabilities that utilize Bonzo Finance lending as a liquidity layer

- Testnet & mainnet launch of Bonzo Finance on Supra’s EVM L1

To get started using Bonzo Finance on the Hedera mainnet, please refer to the quick-start guide in the Bonzo Finance documentation.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, legal, or tax advice. The information contained herein may include forward-looking statements and projections based on current expectations, estimates, and forecasts. Such statements, including but not limited to future protocol features, token launches, partnerships, and performance metrics, involve known and unknown risks, uncertainties, and other factors that could cause actual results to differ materially from any future results, performance, or achievements expressed or implied by such forward-looking statements.

Trading and investing in cryptocurrencies, DeFi protocols, and digital assets involves substantial risk of loss and is not suitable for every investor. The value of digital assets can be highly volatile, and past performance is not indicative of future results. Users should conduct their own research, review the protocol's documentation, and understand the risks involved before interacting with the protocol or making any investment decisions.

Protocol TVL (Total Value Locked), APY rates, rewards, and other metrics mentioned are subject to change based on market conditions and protocol governance. No guarantee is made regarding the accuracy of any statistics, projections, or technical information presented. Users are solely responsible for their decisions to interact with the protocol, including but not limited to supplying assets, borrowing, participating in rewards programs, or engaging with any protocol features.

By using Bonzo Finance, users acknowledge they are interacting with smart contracts at their own risk. Neither Bonzo Finance, its developers, nor its partners make any warranty as to the protocol's security, functionality, or fitness for any particular purpose.

Share this post on