Bonzo Vaults: Automated Yield Strategies for Hedera DeFi

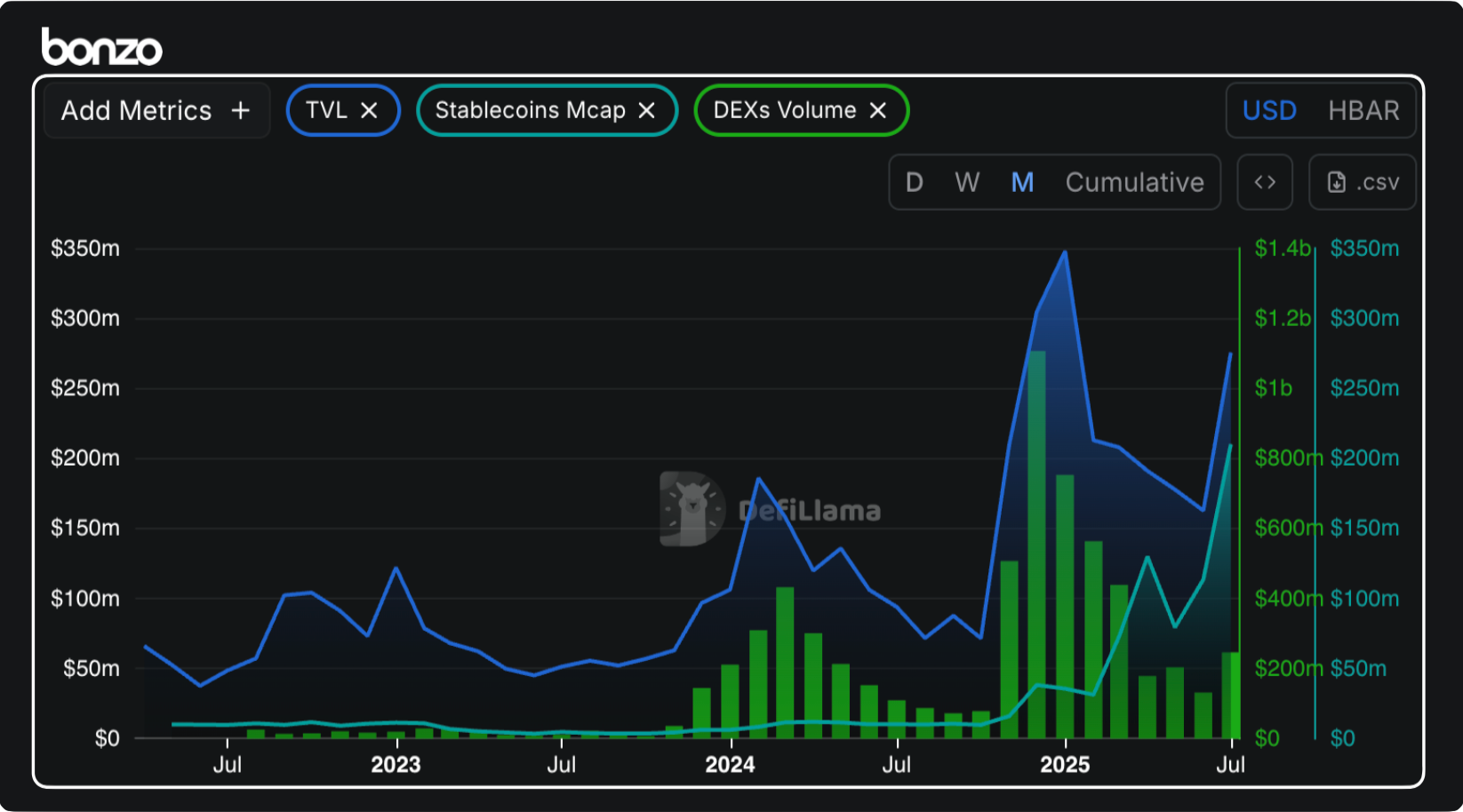

The DeFi ecosystem on Hedera has seen tremendous growth over the past 3 years — with key performance metrics to back its success; total value locked (TVL) 5x’d to ~$275M, monthly DEX trading volume in December 2024 reached $1.1B, and Stablecoin (Hedera native $USDC) liquidity is sitting at $245M.

This growth is primarily attributed to the evolution of DeFi ecosystem protocols, including decentralized exchanges, credit markets (lending & borrowing), collateralized debt positions (CDPs), token launch platforms, bridges, and liquid staking, as well as critical assets such as the Hedera native $USDC stablecoin. Additionally, infrastructure is required to support the operation of these protocols, including Oracles (Supra and Chainlink), RPC relays/mirror nodes (Hgraph.io, ValidationCloud, Arkhia, etc.), wallet provider support (HashPack, Kabila, WalletConnect), and more.

⚠️ Important: Bonzo Vaults involve DeFi risks including smart contract vulnerabilities and market volatility. Strategy vaults require audits, but risks remain. Please research thoroughly and never invest more than you can afford to lose. By continuing on, you agree to have read the full disclaimer appended to the bottom of this article.

Interdependent DeFi Protocols

As permissionless DeFi ecosystems and assets mature and evolve, they trend towards the formation of interdependence and compounding flywheels across multiple protocols — an ecosystem’s combined value is greater than the sum of its parts. This unlocks the ability for users to become more strategic in their transactions across the DeFi ecosystem, from basic transaction types, such as supplying concentrated liquidity to a decentralized exchange for yield, to more advanced ones, including leveraged liquid staking token yield loops in lending protocols for amplified returns.

These advanced strategies can drive greater yield opportunities for users, market efficiencies, and revenue for protocols, as well as key health metrics for the network. However, these strategies can become quite complex — they’re often only deployed by liquidity providers and institutions that have the tools and resources to formulate, monitor, and adjust in real-time, based on market conditions. And that’s where Bonzo Vaults comes into play.

Introducing: Bonzo Yield Strategy Vaults

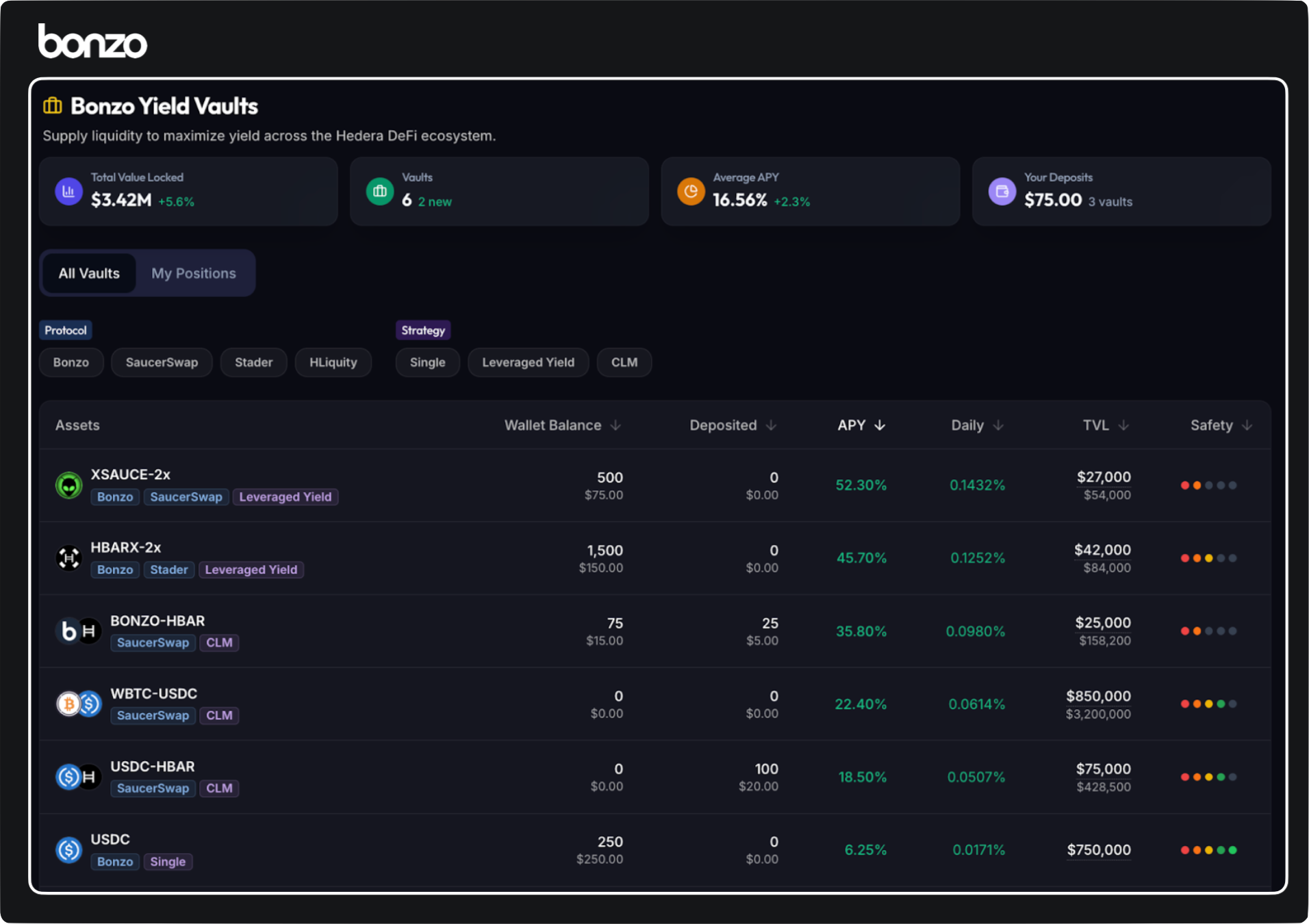

Bonzo Yield Strategy Vaults are the next phase of Bonzo Finance's journey towards becoming "The Liquidity Layer of Hedera" — and a testament to the growth and innovation seen across Hedera's entire DeFi ecosystem. Bonzo Vaults are yield-optimization engines that allow retail and institutional users to automate the management of their liquidity in institutional-grade DeFi strategies, maximizing yield and compounding rewards within and across DeFi protocols on Hedera, without any manual complexity.

Based on Beefy Finance, Bonzo Vaults simplifies liquidity management for users by automating it on their behalf: deposited liquidity is routed to various DeFi protocols across the ecosystem, ranges and configurations are automatically set, positions are rebalanced, and rewards are auto-harvested for compounding returns. Users who’ve deposited liquidity into a vault receive a liquidity pool token, which accrues yield over time.

How do Bonzo Vaults work?

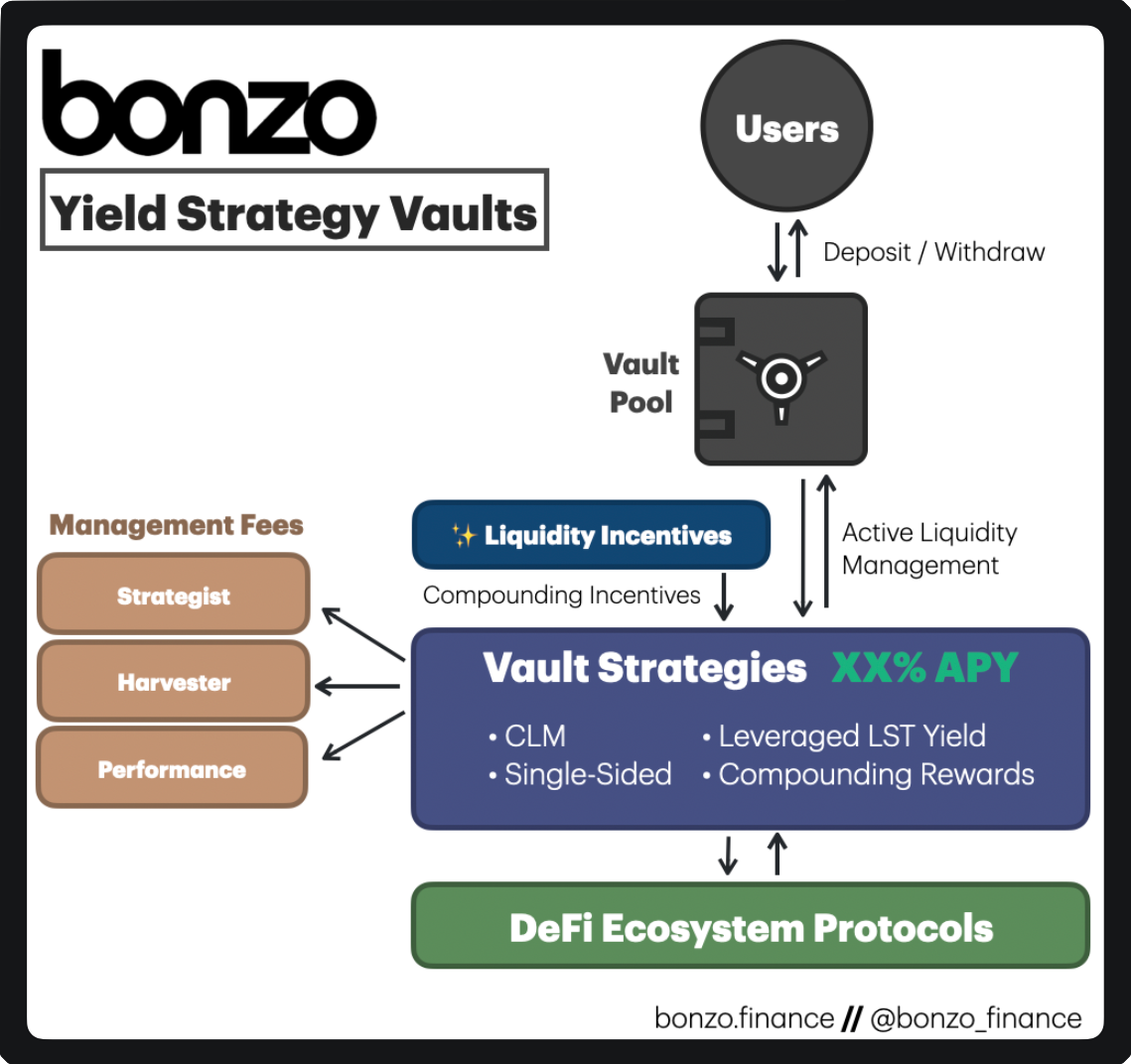

Each Bonzo Vault is a smart contract that accepts a specified asset or pair of assets and issues an interest-bearing vault token, representing the user’s proportional share of the pooled strategy.

A corresponding Strategy Contract manages how and where liquidity is deployed, such as routing it into a SaucerSwap v2 pool or a Bonzo Finance lending market, or a combination of both for more advanced functionalities and yield opportunities. Strategies are modular, allowing the protocol to easily deprecate old vaults (strategies) or deploy new ones without disrupting existing ones.

While Bonzo Finance Labs has developed and audited initial vault strategies, Bonzo Vaults are permissionless and EVM-compatible, allowing any developer to build, audit, and deploy vault strategies for the ecosystem, with the incentive of earning a “vault strategist fee” on yield earned by the vault.

What are some example Bonzo Vault strategies?

Initial strategies will be built, audited, and deployed by Bonzo Finance Labs and partners; however, Bonzo Vaults are permissionless, allowing any developer to build and deploy vault strategies on Bonzo Finance.

Found below are example Bonzo Vault strategies; the strategies outlined are for informational purposes only and subject to change upon launch of the protocol.

⚠️ Important: Bonzo Vaults involve DeFi risks including smart contract vulnerabilities and market volatility. Strategy vaults require audits, but risks remain. Please research thoroughly and never invest more than you can afford to lose. By continuing on, you agree to have read the full disclaimer appended to the bottom of this article.

CLM (Concentrated Liquidity Management)

This strategy utilizes SaucerSwap v2 concentrated liquidity pools, focusing on optimizing yield from trading fees. CLM (Concentrated Liquidity Manager) allows users to access the higher yields of concentrated liquidity without the complexity of manual position management.

This vault strategy allows users to supply any supported token pair into the vault, then deploys them into two complementary positions:

- A main 50/50 position that captures trading fees across a moderate price range.

- An "alt" single-sided position that keeps excess tokens (from natural pool imbalances) actively earning within a smaller strategic range.

This dual-position approach enables depositors to earn maximum trading fees by keeping 100% of capital deployed and in range, effectively boosting yield compared to traditional liquidity provision.

The economic risk associated with this strategy focuses on impermanent loss resulting from price movements between the token pair, particularly during periods of high volatility that can push positions out of range. However, mitigations are in place, including automated 6-hour range resets, calm-zone deposit protection against price manipulation, and the alt position design that avoids realizing impermanent loss through token rebalancing.

Single-Sided Concentrated Liquidity Management

This strategy utilizes SaucerSwap v2 concentrated liquidity pools, focusing on optimizing yield through single-token deposits and inventory-based rebalancing. This strategy allows users to access concentrated liquidity yields without the complexity of managing dual-token positions or frequent rebalancing.

This vault strategy enables users to deposit any supported single token of their choice into the vault, then deploys user funds into concentrated liquidity positions while tracking inventory ratios, rather than reacting to every price movement. The strategy maintains directional exposure to the deposited token by avoiding over-selling, only rebalancing when inventory deviates significantly from target ratios. This approach enables depositors to earn higher trading fees while maintaining preferred token exposure, effectively boosting yield compared to traditional dual-token liquidity supply.

The economic risk associated with this strategy is centered on impermanent loss during periods of extreme volatility, which could push the strategy into unfavorable rebalancing or cause positions to move out of range. However, mitigations are in place, including 100% on-chain smart contract logic without privileged controllers, automated inventory-based triggers that prevent unnecessary swaps, and dynamic range adjustments during high-volatility periods that can lock the vault for safety when needed.

2x Leveraged Liquid Staking Yield

This strategy utilizes the Bonzo Lend protocol in conjunction with protocols which issue liquid staking tokens. This strategy automates “lending loops” between a base asset and its yield-bearing liquid staking token. For example, HBARX is issued by Stader Labs and is a liquid staking token for the base asset HBAR.

This vault strategy allows users to supply the HBARX liquid staking token into the vault for automated management. The vault strategy supplies the HBARX asset to Bonzo Finance as collateral, borrows HBAR against a portion of its value, stakes the borrowed HBAR for HBARX, and again supplies that HBARX to Bonzo. This strategy enables depositors to earn a bonus yield on HBARX by holding more of it (on leverage) than the original deposit, effectively increasing the HBARX APY.

The economic risk associated with this strategy is focused on the borrow APY of $HBAR being higher than the earnings APY on $HBARX, resulting in negative yield; however, mitigations are in place to prevent the ability for more $HBARX to be supplied to the strategy if the borrow APY for $HBAR exceeds this threshold.

Who can use Bonzo Vaults?

- Retail & Institutional DeFi Users can utilize Bonzo Vaults to automate liquidity across the Hedera DeFi ecosystem and maximize yield opportunities. Bonzo Vault strategies make institutional-grade liquidity management available to everyone.

- Ecosystem Projects can utilize Bonzo Vaults to help bootstrap liquidity for a token launch or the release of a new DeFi protocol. In both instances, Bonzo Vaults allow projects to deploy a vault and apply liquidity incentives of their native token to incentive deposits — for a token launch, this might be the the deployment of a CLM vault strategy that routes user deposits of said token to its SaucerSwap v2 pool, supporting trading; for a newly launched DeFi protocol, vaults can be uniquely configured to the protocol, and support bootstrapping user deposits into its pools with active management.

- EVM Developers with experience in DeFi can build, audit, and deploy vaults that offer the ecosystem new and unique yield strategies, earning them a continuous “vault strategist” fee based on the vault's total yield earned. This incentive model supports the development of new and novel yield strategies across Hedera DeFi, benefiting protocols associated with the strategy and the broader retail and institutional user base.

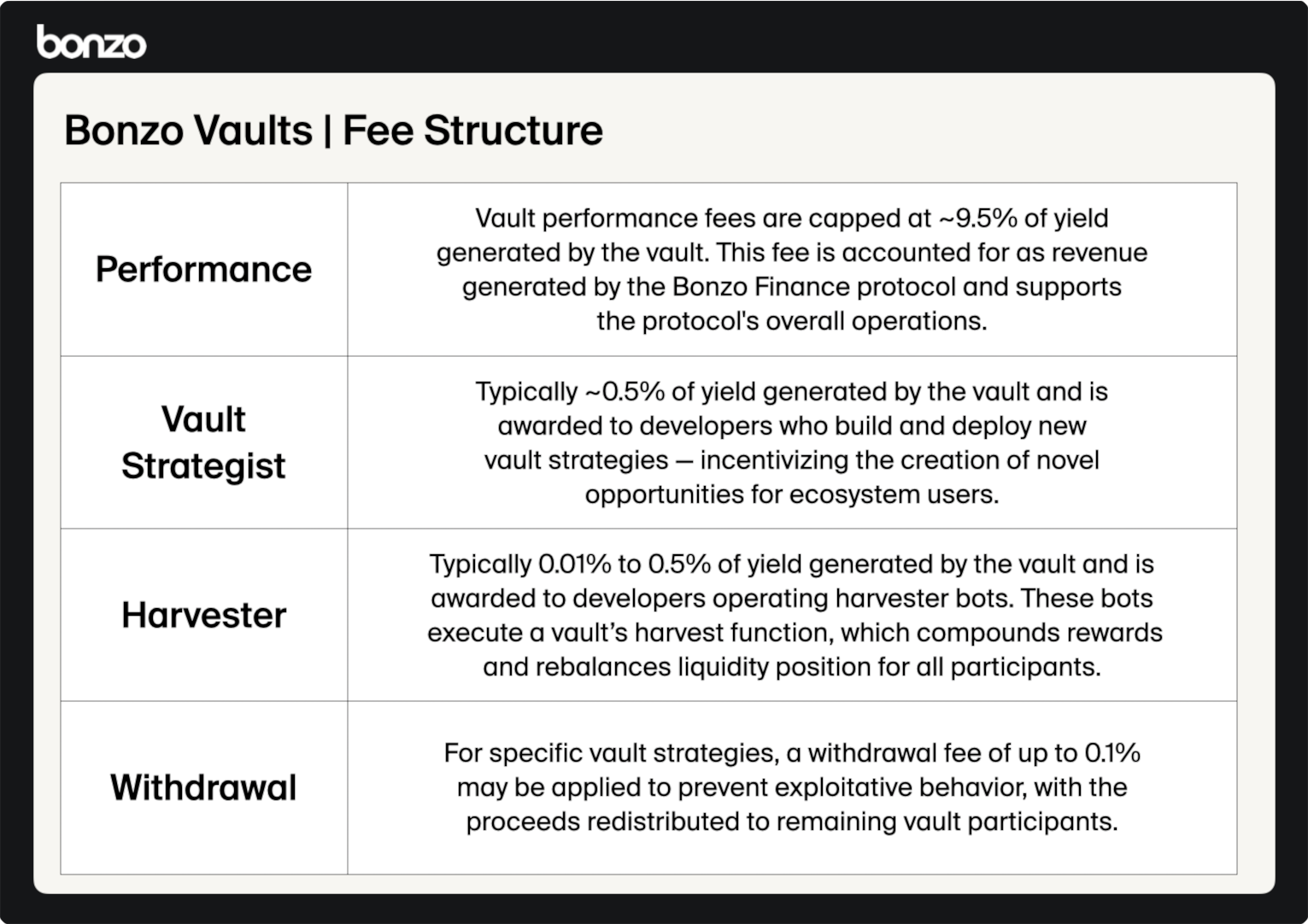

What is the fee structure for Bonzo Vaults?

Bonzo Vaults utilize an open-source architecture with a transparent fee structure where all costs are included in the displayed APY. The comprehensive fee breakdown comprises several components outlined below.

⚠️ Important: The fee structure and estimated percentages outlined below are for informational purposes and subject to change.

Beyond these protocol fees, users should account for standard network transaction fees (gas) paid to Hedera when depositing, withdrawing, or interacting with vaults; however, these fees are typically minimal given Hedera's low-cost, fixed-fee structure.

What are the risks of using Bonzo Vaults?

While Bonzo Vaults offers new and unique yield optimization opportunities, users must evaluate the risks. If utilizing DeFi protocols, it's generally recommended to diversify across multiple protocols / strategies and never invest more than you can afford or are willing to lose. Past performance of any vault is never indicative of future results, and utilization of vault strategies should be considered a high-risk DeFi activity.

Smart Contract Risk

Despite audits, all DeFi protocols carry the inherent risk of smart contract vulnerabilities. Bugs in vault strategies, underlying protocols, or unexpected interactions between contracts could result in partial or total loss of funds. Bonzo Vault strategies are currently being audited by Halborn, with full audit reports to be made available here.

Market Risk

All vault strategies are subject to market volatility and fluctuations in asset prices. Concentrated liquidity strategies face impermanent loss risks, while leveraged strategies amplify both gains and losses. Users may receive fewer tokens than initially deposited, especially during periods of high volatility.

Protocol Dependency Risk

Bonzo Vaults rely on multiple underlying protocols (SaucerSwap, Bonzo Lend, Stader Labs, etc.). If any of these protocols experience technical issues, governance changes, or security breaches, it can impact the performance or accessibility of the vault.

Liquidity Risk

During extreme market conditions or protocol issues, users may experience delays in withdrawing funds or may not be able to exit positions immediately. Some strategies may have cool-down periods or emergency pause mechanisms that temporarily lock deposits, allowing for a controlled approach.

Counterparty Risk

Strategies involving lending, borrowing, or liquid staking expose users to counterparty risks from the underlying service providers. For example, lending protocols may experience extreme variable APY fluctuations for borrowed assets.

The Next Era of DeFi on Hedera

Bonzo Vaults are the next phase of Bonzo Finance's journey towards becoming "The Liquidity Layer of Hedera" and a testament to the growth and innovation seen across the Hedera DeFi ecosystem.

Whether you're a retail or institutional user seeking novel DeFi opportunities, a new DeFi project or token issuer on Hedera looking to bootstrap liquidity, or a developer interested in building innovative strategies, Bonzo Vaults offers many opportunities to participate in this next era of DeFi on Hedera.

Get notified when Bonzo Vaults goes live. Join the official Bonzo Finance Discord, follow us on 𝕏, and sign up for the official Bonzo Finance newsletter.

⚠️ Disclaimer

This blog post is provided for informational purposes only and does not constitute financial, investment, legal, or securities advice. The information contained herein should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any securities or investment strategies.

Risk Disclosure: Participation in decentralized finance (DeFi) protocols involves significant risks, including but not limited to: smart contract vulnerabilities, market volatility, regulatory uncertainty, and potential total loss of funds. Token values may fluctuate significantly and past performance does not predict future results.

No Investment Advice: Nothing in this communication should be interpreted as investment advice or a recommendation to purchase, sell, or hold any digital assets. Participants should conduct their own research and consult with qualified professionals before making any financial decisions.

Forward-Looking Statements: This post contains forward-looking statements regarding the protocol's plans and expectations. Actual results may differ materially from those expressed or implied. The protocol reserves the right to modify or discontinue programs at any time without notice.

Jurisdictional Limitations: This information may not be available to persons in certain jurisdictions where such distribution would be contrary to local law or regulation.

By accessing this information, you acknowledge that you have read, understood, and agree to be bound by these terms and that you are accessing this information at your own risk.

Share this post on