Now Live: Bonzo Yield Strategy Vaults

⚠️ This blog post is for educational purposes only and does not constitute financial advice; DeFi protocols are inherently risky and can result in complete loss of funds. By reading this post, you fully acknowledge the risks and disclaimers appended to the bottom of this blog posting.

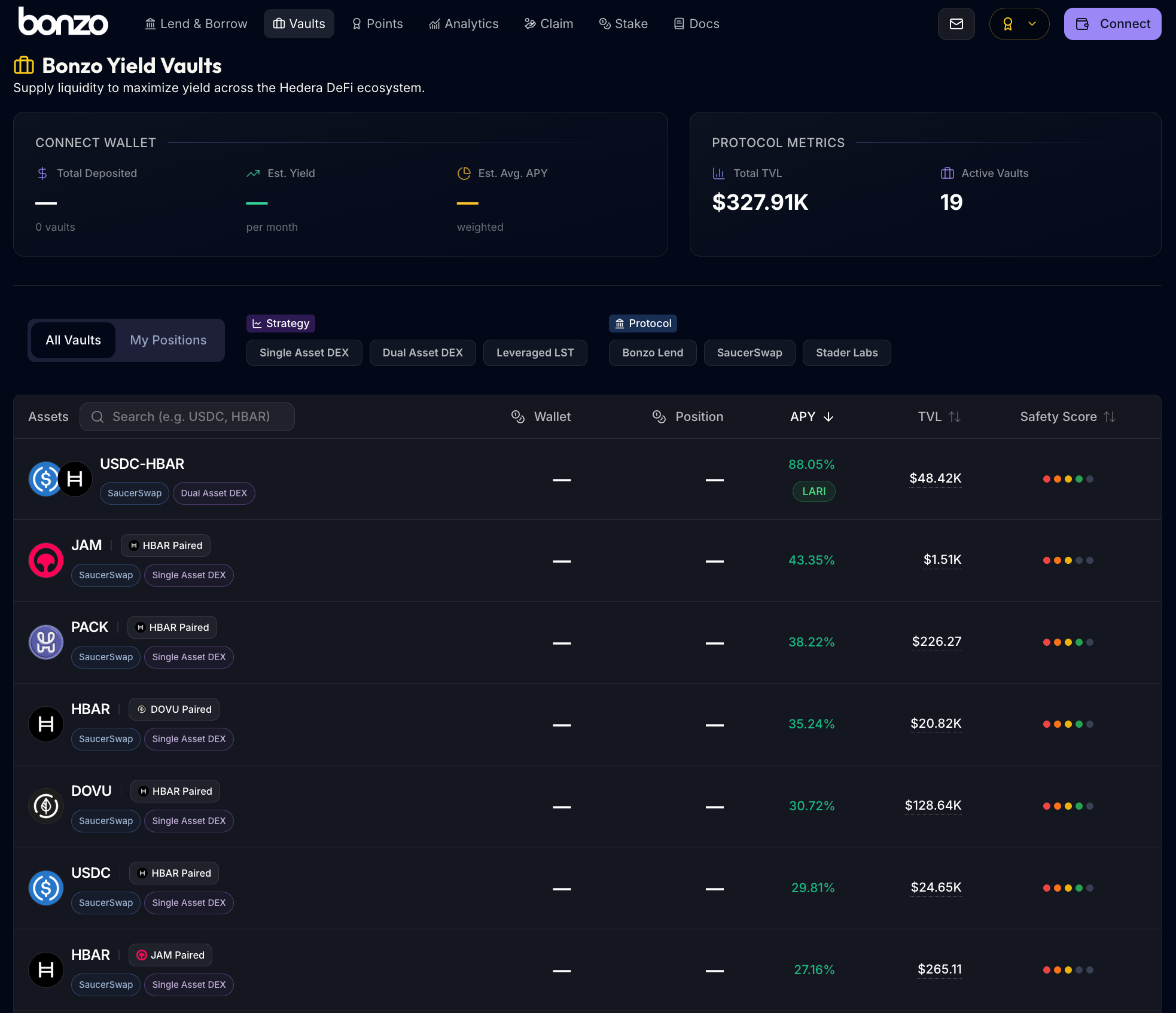

Bonzo Yield Strategy Vaults are the next phase of Bonzo Finance's journey towards becoming "The Liquidity Layer of Hedera".

Bonzo Vaults are automated yield-optimization engines (EVM smart contract based) that allow retail and institutional users on Hedera to automate the management of their liquidity via institutional-grade DeFi strategies, maximizing yield and compounding rewards within and across DeFi protocols on Hedera, without the manual complexity.

With open source contract strategies based on Beefy Finance and ICHI, Bonzo Vaults simplifies liquidity management for users by automating it on their behalf: deposited liquidity is routed to DeFi protocols on Hedera, liquidity ranges and configurations are automatically set, positions are regularly rebalanced, and yield is auto-harvested for compounding returns. Users who’ve deposited liquidity into a vault receive liquidity pool tokens, which represent vault share positions.

Users can try out Bonzo Vaults (beta) today at https://app.bonzo.finance/vaults/

How do Bonzo Vaults work?

Each Bonzo Vault is a smart contract that accepts a single asset or pair of assets and issues a vault liquidity pool token, representing the user’s proportional share of the pooled strategy.

For most vaults, a corresponding Strategy Contract manages how and where liquidity is deployed, such as routing it into a SaucerSwap v2 pool or a Bonzo Finance lending market, or a combination of both for more advanced functionalities. Strategies are modular, allowing the protocol to easily deprecate old vaults (strategies) or deploy new ones without disrupting existing ones.

While Bonzo Finance Labs has developed and audited initial vault strategies, Bonzo Vaults are permissionless and EVM-compatible, allowing any developer to build, audit, and deploy vault strategies for the ecosystem, with the incentive of earning a “vault strategist fee” on yield earned by the vault.

What are the initial vault strategies?

A strategy is a modular smart contract that decides how the assets in a vault are put to work.

When users deposit into a vault, the vault holds the deposits and handles all of the accounting (minting/burning vault share tokens, tracking deposits/withdrawals, etc.) — the vault also operates various strategies for liquidity automation, yield harvesting, and auto-compounding of rewards.

You can view more details about each strategy supported by Bonzo Vaults, found below, in the documentation.

Single Asset DEX

The Single Asset DEX vault strategy allows anyone to earn yield from concentrated liquidity pools on ecosystem DEXs (like SaucerSwap), without having to manage ranges, NFTs, or rebalance positions themself.

Under the hood, Single Asset DEX strategy vaults are liquidity management contracts that takes a single asset deposit, creates concentrated-liquidity positions for it, and actively keeps all positions in a "productive price range".

How the Single Asset DEX vault strategy works:

- Deposit a single token (which gets paired with its underlying pool asset),

- Receive fungible vault share tokens representing your share of the vault, and,

- Over time, your share is backed by more of both underlying tokens as fees are earned and reinvested (auto-compounding).

Learn more about the Single Asset DEX strategy in the documentation.

Dual Asset DEX

The Dual Asset DEX vault strategy has one job: keep as close to 100% of the liquidity deployed in range and earning fees for users. That includes all deposits, the trading fees currently building up in the pool, and all past fees that have already been compounded back into the position.

Whenever a user deposits or withdraws — or a scheduled "harvest" function runs — the vault strategy withdraws liquidity from the pool and rebalances the concentrated-liquidity position. First, it pulls all liquidity out of the underlying DEX pool and collects any accrued fees, so it is temporarily holding all of both tokens. From there, it creates two positions in the pool:

- A Main Position, where it uses a roughly 50/50 mix of the pair and deploys it into a symmetric price range around the current market price. This is the “core” concentrated liquidity position that earns most of the trading fees while the price stays in that band.

- An Alt Position, built from any leftover of the token that has become "overweight" as prices moved. Instead of selling those extra "overweight" tokens to rebalance the pool, the strategy intentionally parks it in a narrower, single-sided band that hugs one side of the main position. This keeps the excess token deployed and fee-earning, instead of idle or immediately sold / deposited into the 50/50 range.

Over time, market prices move — if the vault never adjusted, the positions would drift out of range, stop earning, and leave the liquidity supplier overexposed to the weaker token. To avoid that, the strategy periodically checks the current pool price, chooses a fresh range around it, and rebuilds the same main + alt structure around the new price. In Bonzo Vaults, this is done through an on-chain moveTicks() style function that is called automatically every so often to keep things in a healthy band and resist short-term price manipulation.

The net effect is that all liquidity in the vault is continuously repositioned around the market price, with a balanced core and a single-sided band for any excess, so almost all of the liquidity stays active and earning fees — without the strategy constantly selling tokens just to rebalance, which is where many users who manage liquidity themselves in a SaucerSwap v2 pool end up experiencing significant impermanent loss.

Learn more about the Dual Asset DEX strategy in the documentation.

Leveraged LST

The Leveraged LST strategy allows anyone to earn additional yield on their liquid staking token holdings (like HBARX). Under the hood, Leveraged LST strategy vault operations include the following transactions and protocols:

- User deposits liquid staking tokens (LSTs), such as HBARX, into the vault.

- The vault routes and supplies this token (as collateral) to the Bonzo Lend protocol.

- The vault borrows the LST's underlying base asset from Bonzo Lend (such as HBAR).

- With a low loan-to-value ratio, bolstering additional prevention of liquidation.

- The vault stakes the borrowed funds (base asset) for more LSTs via a staking provider protocol.

- The vault supplies those LSTs to the Bonzo Lend protocol.

During withdraw from a Leveraged LST strategy vault, the operations cited above are performed in reverse — however, instead of un-staking the LST for the underlying base asset, the LST is swapped, using SaucerSwap, to circumvent cool-down periods employed by liquid staking token providers.

⚠️ Please note, the Leveraged LST strategy vault for $HBARX is currently under maintenance, with deposits disabled — it will be back online shortly.

Who does Bonzo Vaults benefit and how?

Retail & Institutional Users

Bonzo Vaults democratizes access to institutional-grade yield strategies that were previously only available to sophisticated market makers and liquidity managers. Users no longer need to monitor positions, adjust ranges, or manually harvest and compound rewards — deposit once and let the vault handle the rest.

Strategies automatically manage concentrated liquidity positioning, rebalancing, and fee optimization, eliminating the need to manage LP NFTs or understand complex range mechanics. Single-asset deposit options mean users don't need to hold balanced pairs or understand optimal range configurations to participate in concentrated liquidity opportunities.

DeFi Protocols & Token-based Projects

Protocols and token projects benefit from deeper, more efficient liquidity across Hedera's DeFi ecosystem. Vault-managed positions keep liquidity actively deployed within productive price ranges, resulting in reduced slippage for traders — which drives more trading volume to DEXs like SaucerSwap v2.

Lower slippage attracts more traders, generating more fees for liquidity providers and creating a positive flywheel effect for the entire ecosystem. Token projects can also leverage vault strategies to attract and retain liquidity more effectively, without relying on unsustainable incentive programs or manual market-making.

The Hedera DeFi Ecosystem

Bonzo Vaults strengthens Hedera's position as a competitive DeFi destination. Automated yield optimization attracts capital that might otherwise remain idle or flow to other chains, increasing total value locked across Hedera protocols.

Simplified liquidity management lowers the barrier for new users entering Hedera DeFi, accelerating ecosystem growth and network effects. As LayerZero (Stargate) and other bridging solutions bring wrapped assets to Hedera, Bonzo Vaults provides immediate yield opportunities for that incoming liquidity — this offers bridged capital and users a productive home and a reason to stay.

What are the risks of using Bonzo Vaults?

While Bonzo Vaults offers new and unique yield optimization opportunities, users must be aware of several risks:

Smart Contract Risk: Despite rigorous audits, all DeFi protocols carry the inherent risk of smart contract vulnerabilities. Bugs in vault strategies, underlying protocols, or unexpected interactions between contracts could result in partial or total loss of funds. Bonzo Vault strategies are currently being audited by Halborn, with complete audit reports to be made available here.

Market Risk: All vault strategies are subject to market volatility and fluctuations in asset prices. Concentrated liquidity strategies face impermanent loss risks, while leveraged strategies amplify both gains and losses. Users may receive fewer tokens than initially deposited, especially during periods of high volatility.

Protocol Dependency Risk: Bonzo Vaults rely on multiple underlying protocols (SaucerSwap, Bonzo Lend, Stader Labs, etc.). If any of these protocols experience technical issues, governance changes, or security breaches, it can impact the performance or accessibility of the vault.

Liquidity Risk: During extreme market conditions or protocol issues, users may experience delays in withdrawing funds or may not be able to exit positions immediately. Some strategies may have cool-down periods or emergency pause mechanisms that temporarily lock deposits, allowing for a controlled approach.

Counterparty Risk: Strategies involving lending, borrowing, or liquid staking expose users to counterparty risks from the underlying service providers. For example, lending protocols may experience extreme variable APY fluctuations for borrowed assets.

Users should carefully evaluate their risk tolerance, diversify across multiple strategies, and never invest more than they can afford to lose. The past performance of any vault is never indicative of future results, and all vault strategies should be considered a high-risk activity.

⚠️ Disclaimer

This blog post is provided for informational purposes only and does not constitute financial, investment, legal, or securities advice. The information contained herein should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any securities or investment strategies.

Risk Disclosure: Participation in decentralized finance (DeFi) protocols involves significant risks, including but not limited to: smart contract vulnerabilities, market volatility, regulatory uncertainty, and potential total loss of funds. Token values may fluctuate significantly and past performance does not predict future results.

No Investment Advice: Nothing in this communication should be interpreted as investment advice or a recommendation to purchase, sell, or hold any digital assets. Participants should conduct their own research and consult with qualified professionals before making any financial decisions.

Forward-Looking Statements: This post contains forward-looking statements regarding the protocol's plans and expectations. Actual results may differ materially from those expressed or implied. The protocol reserves the right to modify or discontinue programs at any time without notice.

Jurisdictional Limitations: This information may not be available to persons in certain jurisdictions where such distribution would be contrary to local law or regulation.

By accessing this information, you acknowledge that you have read, understood, and agree to be bound by these terms and that you are accessing this information at your own risk.

Share this post on