Now Live: Public Testnet of Bonzo Finance

The Bonzo Finance Labs team is excited to announce the launch of the Bonzo Finance protocol on the Hedera testnet, a testnet HTS token faucet in the official Discord, updated homepage, and official documentation. This marks a significant milestone along Bonzo Finance Lab’s journey of ushering in the DeFi 2.0 ecosystem on Hedera via decentralized lending & borrowing functionality.

Testnet availability allows everyone to explore and interact with the Bonzo Finance protocol in a test environment using testnet HTS assets, while providing valuable feedback and insights to the Bonzo Finance Labs team as they prepare the protocol for mainnet launch.

If you’re new to Bonzo Finance, you can learn more about the protocol in the official documentation.

Bonzo Finance Testnet Launch Details

The Bonzo Finance testnet instance is now live and accessible at https://testnet.bonzo.finance. The Bonzo Finance Labs team invites the community to dive in and experience the future of lending & borrowing on Hedera firsthand.

Supported Testnet HTS Assets

Supported testnet HTS Assets Initially, the Bonzo Finance testnet will support the following HTS assets:

- $HBARX

- $HBAR

- $SAUCE

- $XSAUCE

- $KARATE (coming next week)

These same assets are also available on the testnet instance of the SaucerSwap Labs DEX (https://testnet.saucerswap.finance), ensuring a seamless testing experience for users who wish to explore flash loan and liquidation bot functionality once those features go live.

Supported Ecosystem Wallets

To utilize the Bonzo Finance testnet, users will need a testnet account on the HashPack wallet. The Bonzo Finance protocol initially supports HashPack, with plans to expand support to Blade, Kaliba, and MetaMask Snaps prior to the mainnet launch. This multi-wallet approach ensures that Bonzo Finance is accessible to a wide range of users across the Hedera ecosystem and those joining us from other networks.

Testnet HTS Token Faucet

To facilitate testing and provide users with the necessary assets, a Bonzo Faucet Bot in Discord has been made available; these are the same testnet HTS assets used by the testnet SaucerSwap DEX, ensuring interoperability for testing future functionalities like flash loans and liquidation bots that rely on DEX functionality.

This bot will dispense testnet $HBARX, $SAUCE, $XSAUCE, $USDC, and $KARATE (coming soon) at an 8-hour interval, with a fixed rate of 1 token per account.

Follow these simple steps to create your testnet account in HashPack and receive your testnet tokens:

Step 1

Create a testnet account using HashPack

Step 2

Associate the following token IDs with your testnet account:

- $SAUCE: 0.0.1183558

- $KARATE: 0.0.3772909

- $XSAUCE: 0.0.1418651

- $USDC: 0.0.5449

- $HBARX: 0.0.2231533

If you need more testnet HBAR, please visit https://portal.hedera.com/faucet

Step 3

Send the following command to the Bonzo Faucet Bot channel to receive testnet HTS tokens:

!test_bonzo <TOKEN_NAME> <YOUR_ACCOUNT_ID>For example, to receive $HBARX to testnet account ID 0.0.12345, send:

!test_bonzo HBARX 0.0.12345Disclaimer

The testnet token amounts and interval schedule are subject to change. As always, remain vigilant and cautious – the Bonzo team will never message you directly without your express permission!

Support and Feedback

The Bonzo Finance Labs team values the community's input and are dedicated to providing the best possible user experience. If you encounter any issues or have questions while using the Bonzo Finance testnet, provide your feedback in the #🐞| testnet-feedback channel. Your invaluable feedback will help to refine the protocol and ensure a smooth mainnet launch.

Overview of Bonzo Finance Dashboard

To get started with the Bonzo Finance testnet, please review the following sections and terminologies to familiarize yourself with the Bonzo Finance dashboard.

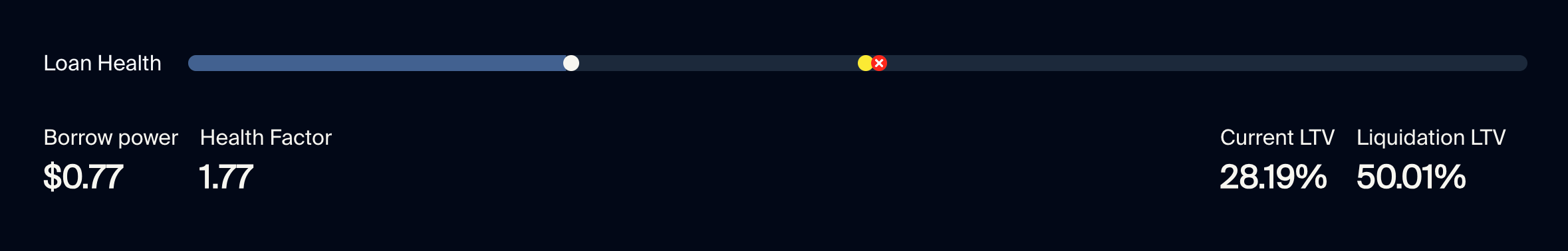

Loan Health Visualization & Metrics

The dashboard displayed at https://testnet.bonzo.finance is a complete overview of the protocol’s functionalities. To get started, you’ll need to first set up a testnet account using HashPack and connect your wallet to the protocol.

- Loan Health

- The Loan Health bar visualizes a user’s Current LTV, Borrow Limit, and Liquidation LTV.

- Borrow power

- The maximum amount of each supported asset that can be borrowed, based on total collateral supplied by the connected account.

- Health factor

- A metric that represents the safety of a borrower's position. It is calculated by dividing the total value of the collateral (multiplied by the liquidation threshold) by the total borrowed amount. A health factor below 1 indicates that the position is undercollateralized and subject to liquidation.

- Current LTV

- Ratio of the value of a user's borrowed assets to their supplied collateral, expressed as a percentage.

- Liquidation LTV

- The loan-to-value ratio at which collateral may be liquidated to repay the loan if the collateral value drops or the borrower fails to maintain the required LTV.

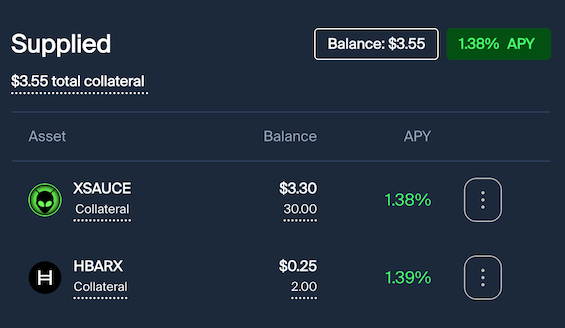

Supplied Assets

The “Supplied” box showcases a user’s currently supplied / collateralized assets and details related to the health of said assets.

- Balance

- The total balance of all assets supplied, both as collateral and not collateral, denominated in USD.

- APY

- The weighted average APY for all supplied assets.

- Total Collateral

- The total value of all assets supplied as collateral, denominated in USD. All assets supplied, by default, are made available as collateral — meaning the user can borrow against the value of these supplied assets.

- Asset

- A list of assets currently supplied by a user, including the token symbol, token icon, and whether or not it’s supplied as collateral.

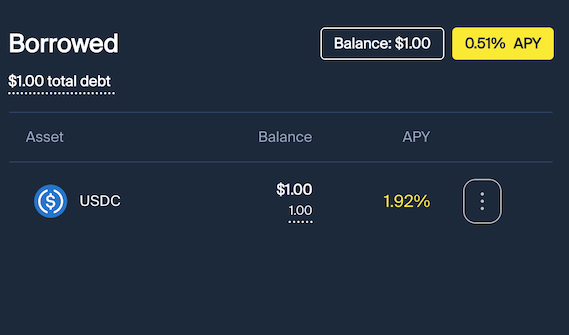

Borrwed Assets

- Balance

- The total balance of all assets borrowed, denominated in USD.

- APY

- The weighted average debt APY for all borrowed assets.

- Total Debt

- The total value of all assets borrowed as collateral, denominated in USD.

- Asset

- A list of assets currently being borrowed by a user, including the token symbol and token icon.

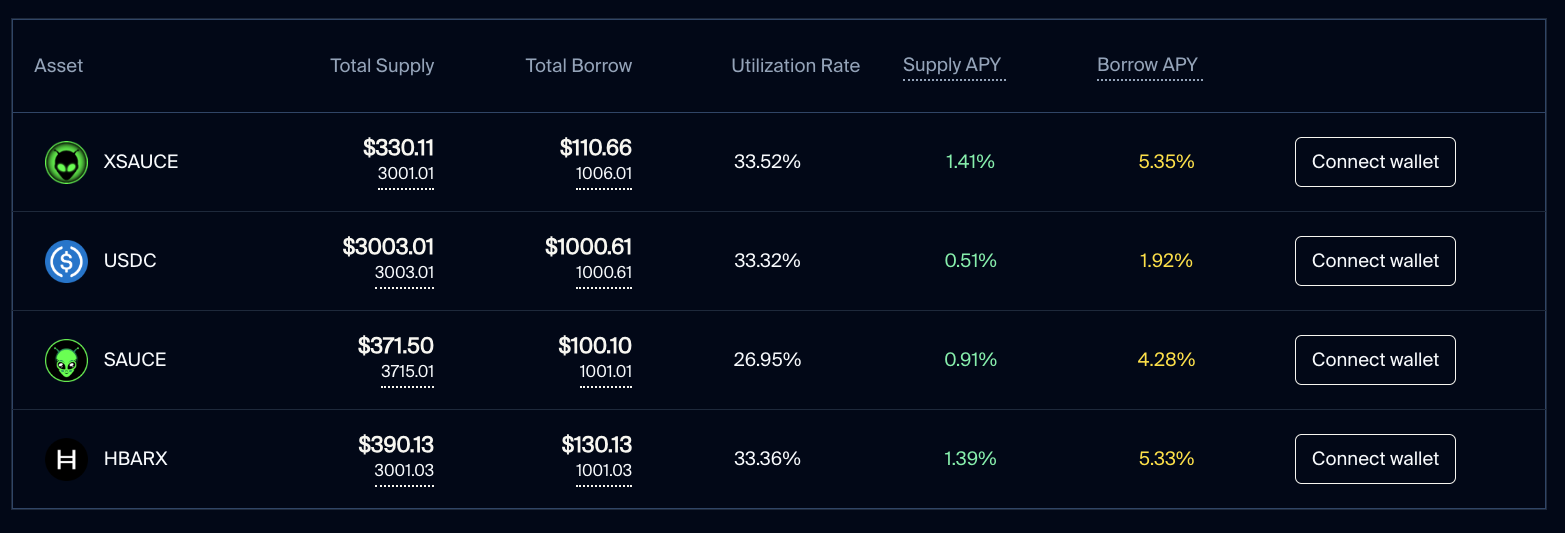

Supported Assets List

The full supported assets list is found at the bottom of the Bonzo Finance dashboard — it includes the following terminologies.

- Asset

- The name, token symbol, and token icon for all supported assets.

- Total Supply

- The total amount of an asset currently supplied by all users of the protocol.

- Total Borrow

- The total amount of an asset currently being borrowed by all users of the protocol.

- Utilization Rate

- The ratio of total borrowed and total supplied of an asset, represented as a percentage.

- Supply APY

- The current earnings APY for supplying an asset.

- Borrow APY

- The current debt APY for borrowing an asset.

Getting Started with Bonzo Finance

In order to get started using the Bonzo Finance protocol on testnet, please review the following instructional tutorials.

Supplying Assets

To get started with decentralized lending & borrowing on Bonzo Finance, users must first supply assets to the protocol.

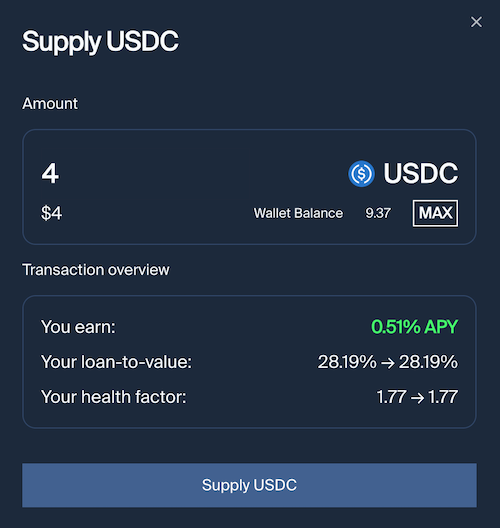

To supply an asset you're currently holding, click on the “...” to the right of an asset found in the full asset list and select Supply. You’ll then see a modal that provides dynamically changing information about this transaction based on the amount inputted.

Once you’ve inputted the amount you’d like to supply — up to your maximum wallet balance — confirm the transaction using the button at the bottom of the modal and sign the required transaction(s) using your HashPack wallet.

Borrowing Assets

After having supplied assets to the Bonzo Finance protocol as collateral, you’ll have the ability to “Borrow” assets.

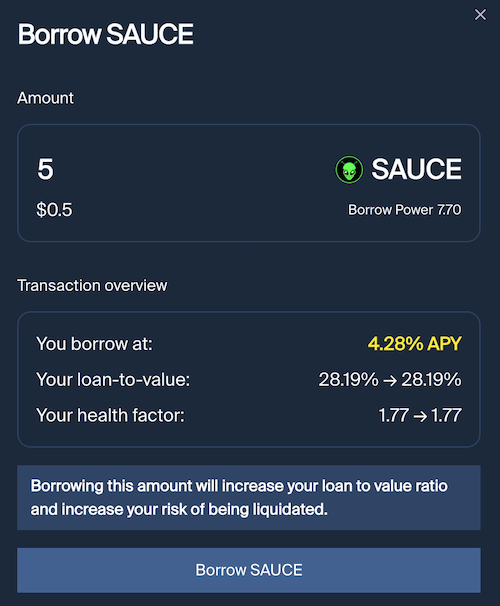

To borrow an asset, click on the “...” to the right of an asset found in the full asset list and select Borrow. You’ll then see a modal that provides dynamically changing information about this transaction based on the amount inputted.

Once you’ve inputted the amount you’d like to borrow — up to your maximum borrow power — confirm the transaction using the button at the bottom of the modal and sign the required transactions using your HashPack wallet.

Enabling / Disabling as Collateral

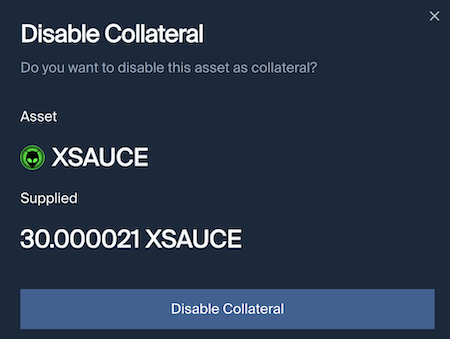

From the “Supplied” box found in the dashboard, you can choose to both disable and enable any asset supplied as collateral.

When supplying any asset to the Bonzo Finance protocol, it automatically supplies the asset as collateral. This means that the asset’s value is able to be borrowed against and increases your borrowing power.

By manually disabling an asset as collateral, the asset is still supplied to the Bonzo Finance protocol and earning an APY, but reduces your borrowing power as the asset is no longer able to be borrowed against.

Conclusion

The launch of the Bonzo Finance testnet is a significant step along the journey of ushering in the DeFi 2.0 ecosystem on Hedera. It’s encouraged for the community to explore the Bonzo Finance protocol on testnet, provide feedback, and join us on this exciting journey.

Stay tuned for more updates and announcements Bonzo Finance approaches mainnet launch by following Bonzo Finance on 𝕏 and joining the community on Discord.

Share this post on