Bonzo Finance: It’s Time to Borrow

Bonzo Finance launched on mainnet October 28th, 2024 — within its first week, Bonzo Finance amassed ~$10M in total-value-locked (TVL) across all supported assets. By December 11th, 2024 Bonzo Finance has achieved ~$22.5M in TVL and continues along the path to fulfilling its mission of becoming The Liquidity Layer of Hedera.

With liquidity thresholds met, the Bonzo Finance protocol has enabled borrowing. The Bonzo Finance Labs team is approaching this key functionality milestone with safety and security in mind, in order to best protect users, the Bonzo Finance protocol, and the Hedera DeFi ecosystem at large.This blog post offers details on the roll-out of borrowing functionality, including:

- Which assets are supported as collateral

- Asset risk parameter configurations

- How the liquidation bot ecosystem works

- Impact on Bonzo Point earnings

- Expanding borrowing capabilities

Assets Supported as Collateral

Upon enabling borrowing, the Bonzo Finance protocol will only allow five low-risk assets to be utilized as collateral. Over time, Bonzo Finance will start to allow more assets to be utilized as collateral and begin lifting risk parameter configurations. If an account has supplied any amount of the following assets, its value can be used as collateral for which to borrow any other asset supplied to the protocol:

- HBAR

- HBARX

- USDC

- SAUCE

- XSAUCE

Asset Risk Parameter Configurations

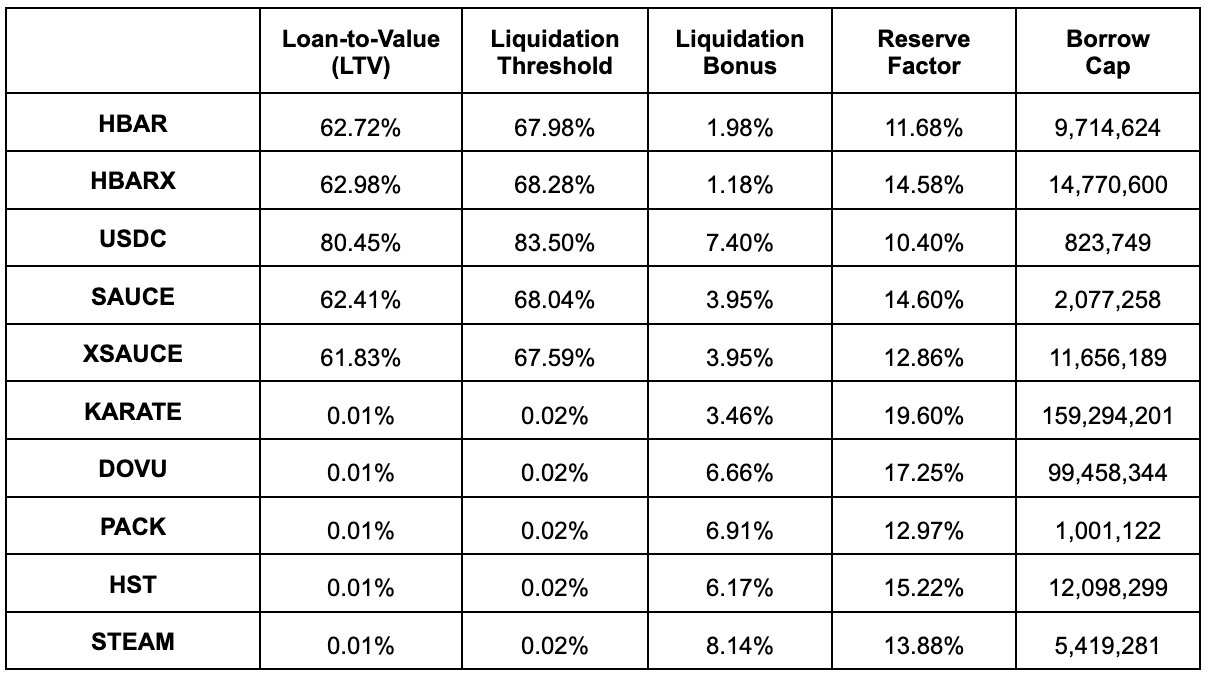

The following risk parameters have been individually configured across all assets for Bonzo Finance, determined by the risk analysis / management provider Ledger Works:

- Loan-to-Value (LTV): The maximum percentage of an asset's value that a user can borrow. It is determined by the asset's risk profile and helps maintain a healthy level of collateralization.

- Liquidation Threshold: The percentage of the collateral's value at which a borrower's position becomes eligible for liquidation. It is specified for each collateral type and helps maintain a safe cushion for the protocol.

- Liquidation Bonus: An incentive given to liquidators in the form of a bonus on top of the liquidated collateral. It encourages liquidators to participate in the liquidation process and maintain the stability of the protocol.

- Reserve Factor: A percentage of interest payments (protocol fees) that is set aside as protocol reserves, which are used to sustain DAO operations and protocol development. The Reserve Factor also acts as an additional layer of security for the protocol, being employed in cases of shortfall events before activating the Safety Module.

- Borrow Cap: The maximum total amount of an asset that can be borrowed from the Bonzo Finance protocol across all users. Borrow caps help protect the protocol by preventing excessive borrowing of any single asset and maintaining healthy liquidity levels.

Key Asset Risk Parameters

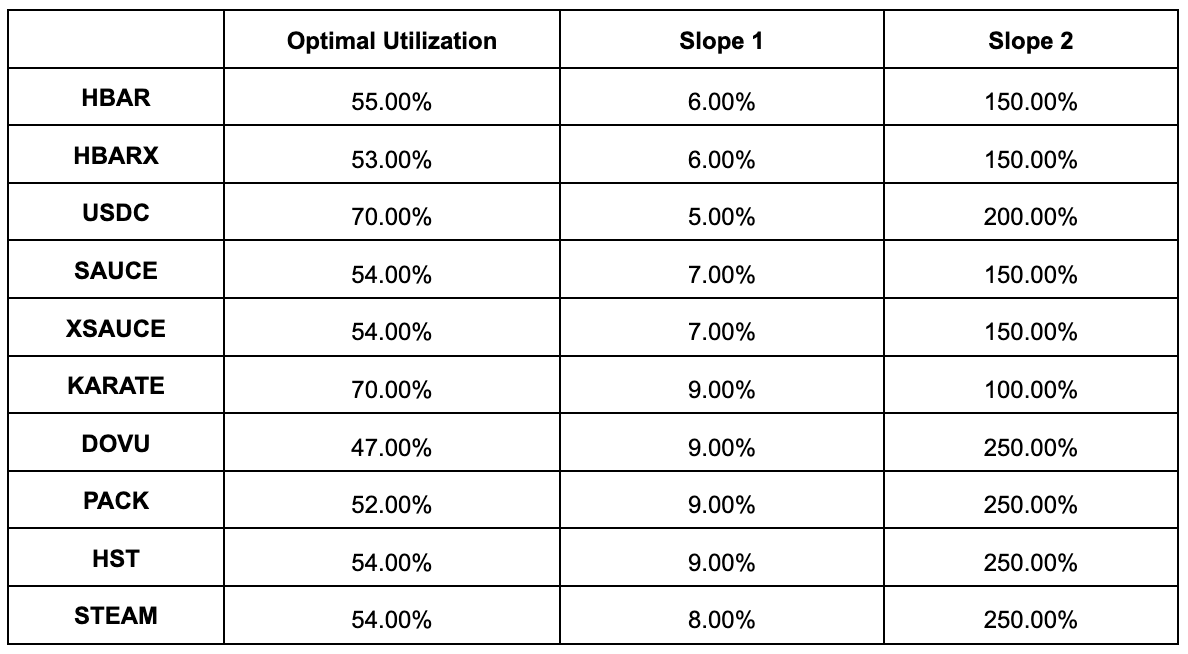

Optimal Utilization, Slope 1, & Slope 2

The following configurations of optimal utilization, slope 1, & slope 2 have been set on a per-asset basis to determine variable interest rates, based on the supply / borrow demand of each asset market.

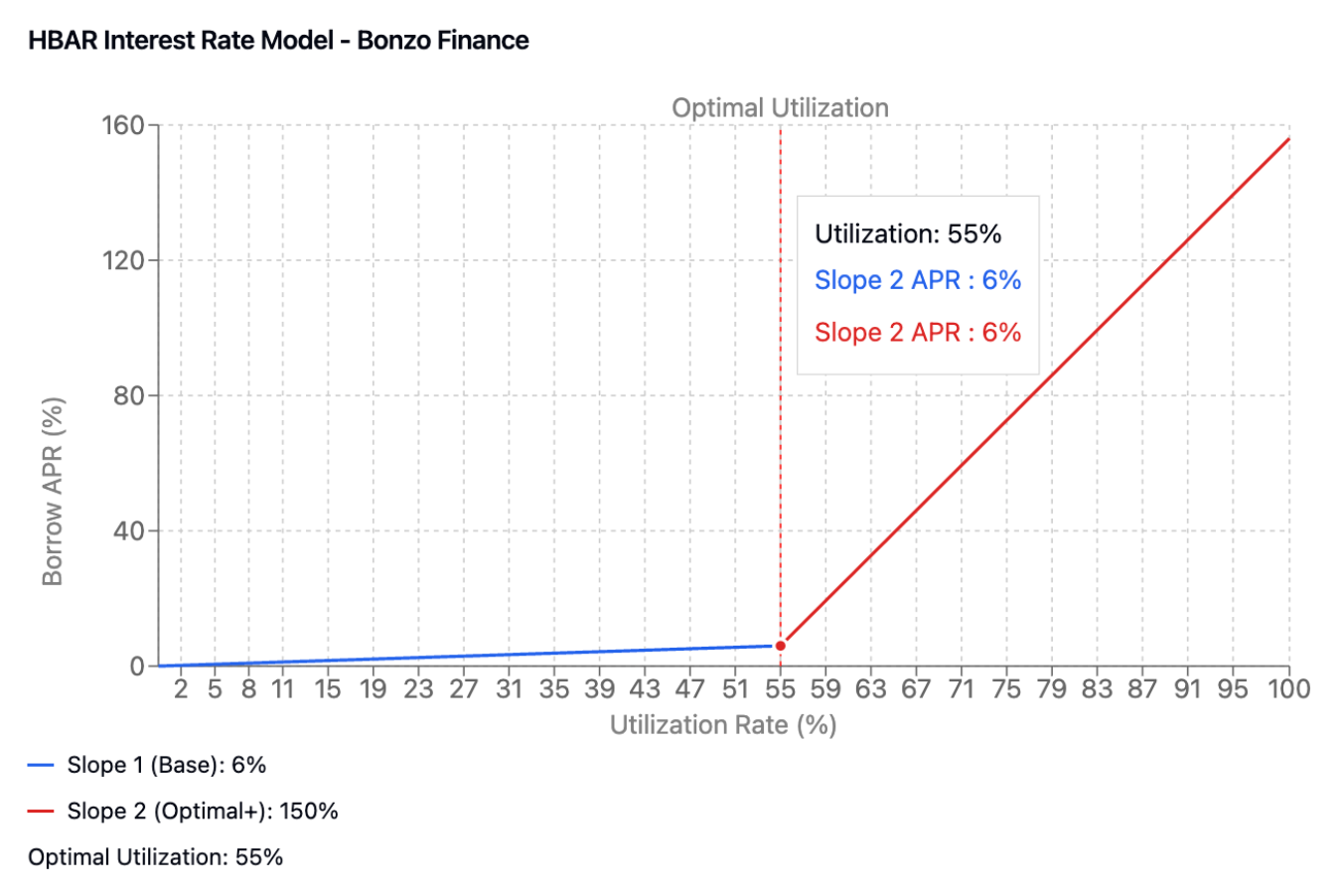

Using HBAR as an example, here is a visual representation of how these configurations translate to variable interest rates, based on utilization (percentage of the HBAR pool being borrowed against the total supply).

To view rates and visualizations for all interest rate models, please visit the “Actual Rates & Parameters” section of the Bonzo Finance “Risk Framework” documentation.

The Liquidation Bot Ecosystem

In the Bonzo Protocol, liquidation occurs when a borrower's collateral value falls below a certain threshold due to changes in asset prices or accrued interest. Liquidators can repay a portion of the borrower's debt and receive a liquidation bonus on the collateral they obtain. This process helps maintain the protocol's solvency and incentivizes liquidators to participate in this activity.

When a borrower's position becomes undercollateralized, it becomes eligible for liquidation. This happens when their Health Factor falls below 1. The Health Factor is a key metric calculated as:

Health Factor = (Total Collateral Value × Liquidation Threshold) / Total Borrowed ValueThe liquidation bonus serves two important purposes. First, it incentivizes liquidators to participate in the liquidation process, which is crucial for maintaining the protocol's overall solvency. Second, it helps compensate liquidators for any costs they might incur during the liquidation process, such as transaction fees or potential slippage if they choose to exchange the received collateral.

After receiving the collateral, liquidators have complete discretion over what to do with it. They might:

- Hold onto the collateral if they believe in its future value

- Exchange it for other assets through decentralized exchanges

- Use it for other purposes within the DeFi ecosystem

For borrowers, this means maintaining a healthy buffer above a Health Factor of 1 is crucial. They can do this by either:

- Repaying some of their borrowed debt to reduce their liability

- Adding more collateral to increase their security margin

- Monitoring asset price movements that might affect their position's health

Operating a Liquidation Bot

Anyone with developer experience can operate a liquidation bot on Hedera, and participate in the ecosystem to earn rewards for keeping the protocol healthy.

Upon enabling borrowing, the Bonzo Finance Labs team will operate multiple liquidation bots, with each bot running on its own infrastructure to ensure redundancy, availability, and efficiency in performing liquidations.If you’re a developer who’s interested in operating a liquidation bot, the Bonzo Finance Labs team has provided step-by-step instructions for setting up a bot. In addition, the official Bonzo Finance Discord has a dedicated channel for the liquidation bot ecosystem to ask questions and get technical support from the Bonzo Finance Labs team.

Bonzo Points for Borrowing

The Bonzo Points program has been a massive hit across the Hedera DeFi ecosystem and has been a key driver of Bonzo Finance TVL and protocol adoption. The points program rewards active community members who supply liquidity to and borrow liquidity from the Bonzo Finance protocol.

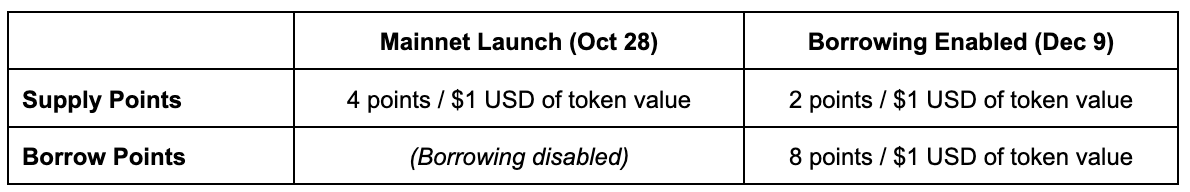

Point earnings are based on the $USD value of supported HTS assets supplied and borrowed, and are distributed on a 24 hour basis. Point earnings convert to claimable $BONZO at the end of every points season, each lasting 3 months, with three seasons in total.

Upon mainnet launch, only the supplying of assets was enabled. Accounts could earn 4 points per $1 USD of token value supplied. Upon enabling borrowing, supply points will drop to 2 points per $1 USD of token value supplied and borrow points will be set at 8 points per $1 USD of token value supplied.

The Future of Borrowing

Over time, the Bonzo Finance protocol will be lifting the risk parameters for many assets. This ensures that more assets supported by the protocol can be used as collateral for borrowing against, as well as larger amounts of value to be borrowed (loan-to-value ratio) based on collateral supplied.Each week the Bonzo Finance Labs team will be performing an assessment with its risk management provider Ledger Works to determine if changes to risk parameters are warranted based on their analysis of individual asset and broader market conditions.

Borrowing on Bonzo Finance marks a pivotal step in delivering secure, user-focused DeFi solutions on Hedera. With a focus on risk management and a deliberate approach to feature rollouts, Bonzo Finance empowers users to borrow with confidence. Whether you’re here to earn, borrow, or just explore Hedera’s expanding DeFi ecosystem, there’s never been a better time to get involved. Get started today at https://app.bonzo.finance.

Share this post on