The Role of Collateralization for Mitigating Risk in Decentralized Lending

Decentralized lending protocols in web3 enable users to lend and borrow cryptocurrencies directly from one another, without relying on traditional intermediaries. Learn more in the previous article: “A Brief Overview of Decentralized Lending & Borrowing in Web3”

When it comes to collateralization for decentralized lending, risk management is critical to the overall stability and long-term success of the protocol. A key risk associated with lending is the potential for borrower default — this is when the borrower fails to repay a loan of cryptocurrency as agreed. In decentralized lending, where loans are issued to pseudonymous borrowers, peer-to-peer, using open source smart contracts and without traditional credit assessments, managing risk becomes even more critical.

This is where collateralization comes into play. Collateralization is the process of a borrower securing a loan by pledging assets of value, such as cryptocurrencies, as collateral to mitigate the lender's risk and ensure repayment of the borrowed funds; it is a risk mitigation mechanism employed by most DeFi lending protocols to protect lenders against borrower default and ensure stability of the protocol.

In this blog post, we'll take a deep dive into the concept of collateralization and its vital role in mitigating risk within the DeFi lending ecosystem, exploring how it works, the different types of collateral used, and the benefits and challenges associated with this risk management approach.

What is collateralization?

Collateralization is a fundamental concept of both traditional and decentralized lending that involves borrowers depositing an asset value as “collateral” for a loan. In the context of decentralized lending protocols, collateral is typically provided in the form of cryptocurrencies, such as Hedera (HBAR), Ethereum (ETH), Wrapped Bitcoin (wBTC), or stablecoins, like USDC and DAI. By requiring collateral, lending protocols ensure there is a tangible asset of value backing the loan, which can be liquidated to repay the lender in case the borrower defaults on their obligations to repay the loan.

In practice, collateralization requires borrowers to deposit a certain amount of cryptocurrency to a protocol’s smart contract before they can take out a loan. The value of the collateral deposited must exceed the value of the loan, and this ratio is known as the loan-to-value (LTV) ratio — this core concept is called over-collateralization.

For example, if a lending protocol has an LTV ratio of 150%, a borrower would need to deposit collateral worth $150 to take out a loan of $100. The LTV ratio helps ensure that there is a sufficient buffer to protect lenders against potential losses due to borrower default OR if the asset being offered as collateral fluctuates in value. If the value of the supplied collateral falls below a certain threshold (known as the liquidation threshold), the collateral is automatically liquidated to repay the loan, minimizing the risk to lenders.

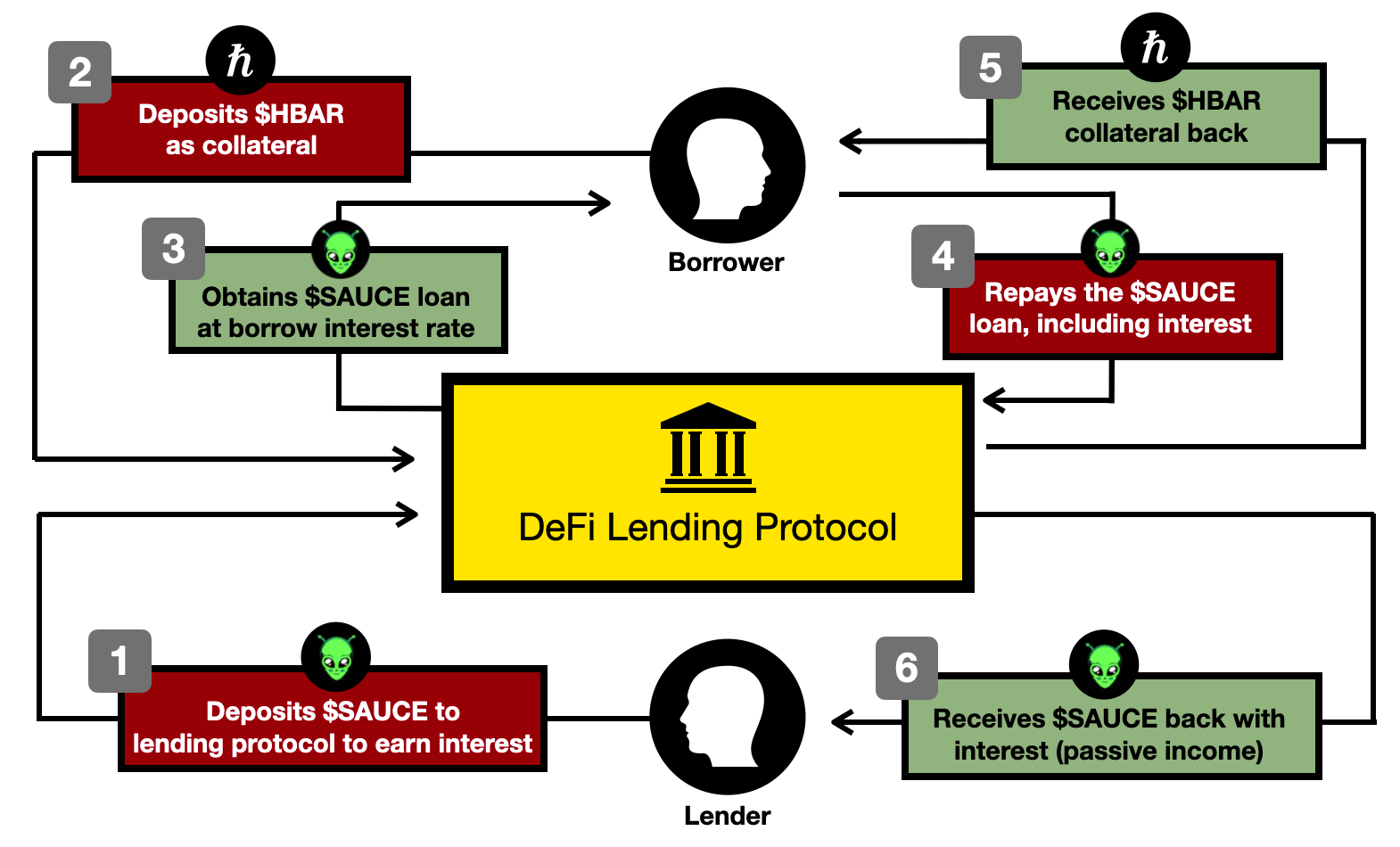

Found below is an example of how this work using $HBAR and $SAUCE.

Benefits and Risks of Collateralization

Collateralization is a double-edged sword in decentralized lending, offering both significant benefits and potential risks. It provides a robust layer of protection against borrower default and helps maintain the stability and solvency of lending protocols. However, it also introduces challenges such as the volatility of cryptocurrency collateral, oracle vulnerabilities, and potential capital inefficiencies.

Benefits of Collateralization

- Protection Against Borrower Default: By requiring borrowers to pledge valuable assets as collateral, lending protocols ensure that there is a tangible asset that can be liquidated to repay lenders in case of default. This mechanism significantly reduces the risk of loss for lenders, making it more attractive for them to participate in DeFi lending.

- Maintain Stability & Solvency of the Protocol: By always having sufficient value backing the loans issued, this fosters trust in the protocol performing these types of financial transactions and encourages more users to engage the protocol. This reduction in risk enabled by collateralization allows lending protocols to offer competitive interest rates to lenders, as the cost of risk associated with unsecured lending is minimized.

Risks of Collateralization

- Cryptocurrency Price Volatility: As the value of cryptocurrencies can fluctuate significantly over short periods, the value of the collateral backing loans may also experience dramatic changes. If the value of the collateral drops below the liquidation threshold, it may trigger a liquidation event, leading to the sale of the collateral at unfavorable prices. This can result in losses for both borrowers and lenders. Furthermore, during market downturns or periods of high volatility, there may be increased liquidity risks, as it may become more difficult to sell the collateral at fair market prices.

- Oracle Price Feed Manipulation: Oracles are responsible for providing real-world data, such as asset prices, to smart contracts. If the oracles are compromised or manipulated, it could lead to incorrect liquidation events or other unintended consequences. This is why it’s important to ensure that oracle providers chosen are sufficiently decentralized and secure, while relying on redundant price feed sources.

- DeFi Ecosystem Capital Inefficiency: Over-collateralization, while necessary for risk mitigation, can lead to capital inefficiency, as borrowers need to lock up more value in collateral than the loan amount they receive. This can limit the overall capital efficiency of the DeFi lending ecosystem.

Collateralization Best Practices & Bonzo Finance's Approach

Requiring borrowers to pledge valuable assets as collateral helps effectively mitigate risks associated with defaults and ensure the stability and security of the lending ecosystem. Let’s explore the best practices for effective collateralization and take a closer look at how Bonzo Finance incorporates these principles into its lending protocol on the Hedera network.

Effective Risk Management in Collateralization

To effectively manage the risks associated with collateralization while maximizing its benefits, DeFi lending protocols must adopt a range of best practices:

Loan-to-value (LTV) Ratios & Liquidation Thresholds

LTV ratios determine the amount of collateral required relative to the loan amount. And liquidation thresholds define the point at which collateral is automatically sold (liquidated) to repay the loan. By carefully calibrating these parameters based on factors such as the price volatility, liquidity, and average volume of assets used as collateral, lending protocols are better able to strike a balance between risk mitigation and capital efficiency.

Diversifying Collateral Types

Another best practice is diversifying the types of collateral accepted by the lending protocol. By supporting a wide range of cryptocurrency assets, as well as potentially tokenized real-world assets, lending protocols are able to attract a broader user base and reduce the concentration risk associated with relying on a single collateral type. It’s critical to carefully evaluate and monitor the risks associated with each collateral type, such as their price stability, liquidity, and overall market acceptance.

Robust Price Feeds and Liquidation Mechanisms

Implementing robust price feed and liquidation mechanisms is also crucial for effective collateral management. Lending protocols should integrate reliable and tamper-proof price oracles to ensure accurate and up-to-date valuation of collateral assets. This helps to prevent unwarranted liquidations or other unintended consequences arising from incorrect price data. Additionally, liquidation mechanisms should be designed to minimize slippage and ensure that collateral is sold at fair market prices, even during periods of high market volatility or reduced liquidity.

Bonzo Finance's Collateralization Overview

The Bonzo Finance protocol has adopted a sophisticated collateralization framework, based on Aave v2, that incorporates best practices cited above. The protocol supports a diverse range of collateral types, including popular cryptocurrencies like HBAR, ETH, wBTC, as well as stablecoins and Hedera Token Service (HTS)-based project tokens. The risks and benefits of each collateral type have been carefully assessed and the protocol has implemented dynamic LTV ratios and liquidation thresholds that adapt to changing market conditions.

Multi-Oracle Approach

To ensure the accuracy and reliability of price feeds, Bonzo Finance has partnered with leading oracle providers, such as Supra and Pyth, who offer decentralized and tamper-proof price data.

A multi-oracle approach, aggregating price data from two oracle providers, further enhances the robustness of Bonzo’s price feeds.

Optimized Liquidation Bots & Community Participation

Bonzo Finance is pioneering an innovative approach to liquidations by developing user-friendly "liquidation bot" programs. These bots are designed to be accessible to anyone in the Hedera community, allowing them to actively participate in the liquidation process and contribute to the overall health and stability of the platform.

When a borrower's collateral falls below the required threshold, automatically identify and execute liquidation opportunities. This ensures that the protocol can quickly recover the borrowed funds and protect lenders from potential losses.

What’s more exciting is these liquidation bots offer a unique opportunity for Hedera community members to earn rewards. By operating a liquidation bot, users can receive a small percentage of each successful liquidation as an incentive for their participation. This not only encourages greater engagement and collaboration within the Hedera ecosystem but also helps to distribute the benefits of the platform more widely.

Adding Supported Collateral Assets

Bonzo Finance is committed to building a secure and stable lending protocol — a key aspect of this is the careful selection of supported collateral assets.

Initially, the protocol will focus on incorporating major assets that ensure stability, considering factors such as price volatility, liquidity, and trading volume. These assets include HBAR, as well as widely adopted cryptocurrencies like wrapped Ethereum (wETH), wrapped Bitcoin (wBTC), and the stablecoin USDC. By prioritizing established assets, Bonzo Finance aims to create a solid foundation.

As the platform matures and grows, Bonzo Finance is excited to expand its range of supported assets. This includes Hedera Token Service (HTS) tokens of projects built on the Hedera network. The addition of HTS tokens will provide diverse collateral options for users, while supporting the growth, adoption, and liquidity of the wider Hedera ecosystem.

The process of adding new collateral assets will be a collaborative effort, guided by Bonzo token holders participating in the Bonzo Finance DAO. By involving the community in these decisions, Bonzo Finance ensures that the expansion of supported assets aligns with the interests and needs of the broader DeFi ecosystem. The goal is to implement a methodical and reliable process for introducing new collateral assets, balancing innovation with stability and security.

Collateral Rewards: A Unique Functionality

Bonzo Finance is set to implement a unique functionality called "Collateral Rewards," which allows users to earn additional rewards for providing collateral, while their assets are being used as collateral. This innovative approach not only provides an extra incentive for users to participate but also helps to further stabilize the collateral base and reduce the overall risk profile of the platform.

Shaping the Future of Finance with Bonzo

As we’ve just learned, collateralization plays a critical role in mitigating risk for decentralized lending protocols, users, and the DeFi ecosystem at large. Requiring borrowers to deposit valuable assets as collateral protects lenders from potential defaults and ensures the overall stability and security of their lending protocols.

As the DeFi space continues to grow and mature, the importance of robust collateralization mechanisms will only become more evident. Effective collateral management drives future developments and adoption of decentralized lending, enabling greater access for users while minimizing the associated risks.

Bonzo Finance is committed to being at the forefront of decentralized lending on Hedera. By combining industry best practices with additional innovations, such as dynamic LTV ratios, multi-oracle price feeds, collateral rewards, and optimized liquidation bots, Bonzo Finance continues to prioritize security, efficiency, and user empowerment.

We invite you to explore Bonzo Finance, join the community on Discord and 𝕏, and stay updated via newsletter on the latest developments and educational resources as we work together to shape the future of decentralized finance on Hedera.

Legal Disclaimer

The information provided in this blog post is for general informational purposes only and does not constitute financial, investment, legal, tax, or professional advice. The content is not intended to be a substitute for professional advice or services, and you should not rely on the information presented here as a basis for making any financial, investment, legal, tax, or other decisions.

Bonzo Finance makes no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability of the information contained in this blog post. Any reliance you place on such information is strictly at your own risk. In no event will Bonzo Finance be liable for any loss or damage, including without limitation, indirect or consequential loss or damage, arising from your use of or reliance on the information provided in this blog post.

The forward-looking statements made in this blog post are based on current expectations, plans, estimates, and projections. They are subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements. Bonzo Finance undertakes no obligation to update any forward-looking statements to reflect events or circumstances after the date of this blog post.

By reading this blog post, you acknowledge that you have read, understood, and agree to be bound by this disclaimer.

Share this post on